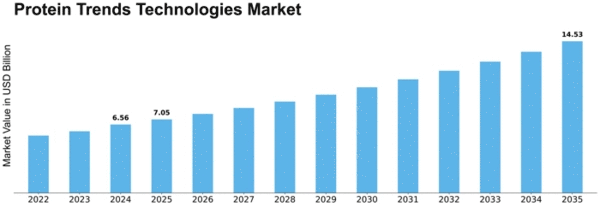

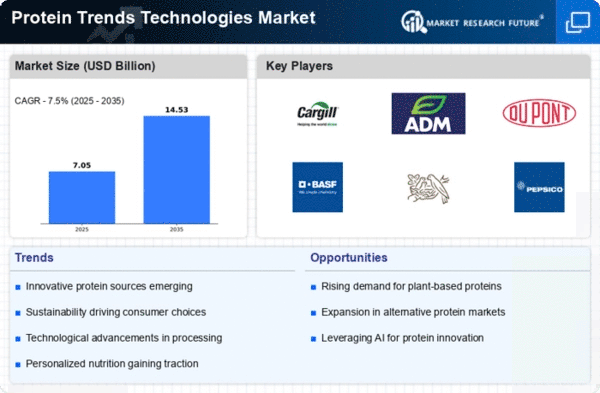

Protein Trends Technologies Size

Protein Trends Technologies Market Growth Projections and Opportunities

Many variables shape the Protein Trends and Technologies market's growth and evolution. Awareness and demand for plant-based protein sources are major factors. Plant-derived proteins are becoming more popular as people adopt healthier lives and worry about the environmental impact of animal-based protein manufacturing. This change in diet has driven the creation and market growth of plant-based protein products like soy, pea, and others.

Advanced protein extraction and processing technologies shape the Protein Trends and Technologies market. Advanced filtration, enzyme-assisted extraction, and processing technologies provide high-quality, functional proteins. These technological advances improve protein product texture, taste, and nutrition, matching consumer expectations and growing the market. Protein technology research and development keep the industry competitive and responsive to consumer needs.

Changing consumer demographics and lifestyles affect protein trends and technology. Vegetarianism, flexitarianism, and interest in alternate protein sources reflect dietary changes. Busy lifestyles and a desire for convenient, healthy meals have raised demand for protein-rich snacks, beverages, and meal replacements. The market reacts with novel protein products that meet varied consumer needs.

Protein Trends and Technologies market regulations matter. Market actors must follow food safety, labelling, and innovative ingredient rules. Regulatory approval protects protein product safety and quality, building consumer trust and market share. Companies in this dynamic business must comply with changing regulations, notably with new proteins and genetic engineering.

The market is affected by economic factors including protein production and processing costs. Protein product affordability and competitive price influence consumer purchases. Protein-rich food production costs are also affected by economic factors, altering manufacturers' pricing strategies. Market operators must balance economic reasons with high-quality protein product demand to stay competitive and sustainable.

Global sustainability and environmental awareness drive Protein Trends and Technologies market growth. Plant-based proteins and cultured meat are becoming more popular as people seek eco-friendly solutions. Sustainable protein solutions are developed and used due to the environmental impact of traditional animal agriculture and the aim to reduce carbon footprints.

Immune-boosting proteins and home-based fitness products have grown because to the COVID-19 pandemic. The epidemic raised health and wellness awareness, driving protein-rich food and supplement purchases. Pandemic-related food supply chain disruptions highlighted the need for resilient and diverse protein sources.

Industry, research, and startup partnerships shape the Protein Trends and Technologies market. Collaboration promotes knowledge sharing, research, and protein technology innovation. Partnerships expand protein product portfolios, allowing enterprises to fulfill market demands with a variety of options."

Leave a Comment