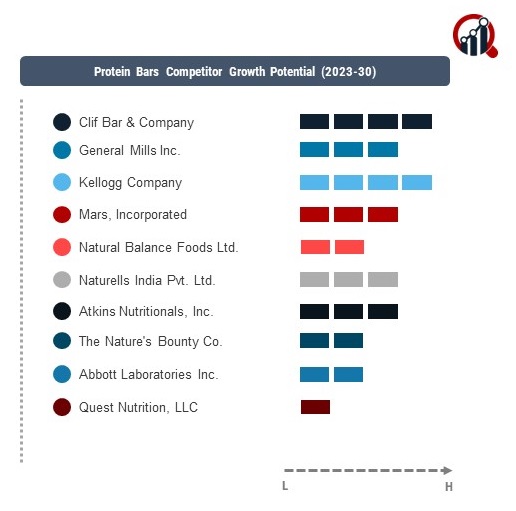

Top Industry Leaders in the Protein Bars Market

Strategies Adopted by Protein Bars Key Players

The Protein Bars market has experienced substantial growth in recent years, driven by the increasing focus on health and fitness. This analysis provides an in-depth look at the competitive landscape, highlighting key players, adopted strategies, factors influencing market share, emerging companies, industry trends, current investment patterns, and a significant development in 2023.

Key Players:

The Protein Bars market are key players known for their commitment to producing high-quality and nutritious protein bar products. Prominent contributors include Quest Nutrition, Clif Bar & Company, KIND LLC, RXBAR, and Premier Nutrition Corporation. These industry leaders leverage their strong brand presence, extensive product portfolios, and effective marketing strategies to establish themselves as major players in the market.

The Protein Bars market deploy various strategies to stay competitive and cater to evolving consumer preferences. Strategies include product innovation, diversification, strategic partnerships, and aggressive marketing. For example, Clif Bar & Company focuses on introducing new flavors and improving the nutritional profile of its protein bars, aligning with consumer demands for both taste and functionality. Such strategies emphasize the importance of adapting to market trends and ensuring product relevance.

Market Share Analysis:

The Protein Bars market involves evaluating various factors that influence competitive positions. Key considerations include the nutritional content of protein bars, taste, pricing strategies, brand visibility, and distribution networks. Companies that effectively balance these factors are better positioned to capture and expand their market share. Additionally, factors such as responsiveness to dietary trends, adherence to quality standards, and consumer trust contribute to market differentiation.

News & Emerging Companies:

The Protein Bars market has seen the emergence of new and innovative companies capitalizing on the growing demand for convenient and protein-packed snacks. In 2023, companies like NutraBlast entered the market, focusing on unique protein bar formulations with added functional ingredients. These emerging players contribute to market diversity, fostering innovation and potentially challenging the established market dynamics.

Industry Trends:

The Protein Bars market revolve around sustainability, clean labeling, and meeting diverse dietary preferences. Key players are investing in research and development to introduce plant-based protein bars, catering to the rising demand for sustainable and plant-centric protein sources. Additionally, investments in clean label initiatives and transparent ingredient sourcing align with consumer preferences for health-conscious and ethical products.

Current investment trends highlight the significance of market expansion and meeting diverse dietary needs. Companies are strategically investing in plant-based protein alternatives, addressing the growing interest in plant-centric diets. Additionally, investments in digital marketing and e-commerce infrastructure underline the importance of reaching consumers directly and capitalizing on the shift towards online purchasing.

Competitive Scenario:

The Protein Bars market is characterized by a focus on taste, nutritional value, and brand image. Companies differentiate themselves through product innovation, marketing effectiveness, and the ability to cater to various dietary preferences. The market is influenced by factors such as sustainability practices, global distribution capabilities, and the ability to adapt to evolving consumer preferences for healthier and functional snacks.

Recent Development

The Protein Bars market in 2023 was Quest Nutrition's acquisition of a leading plant-based protein bar manufacturer. The strategic move aimed to expand Quest Nutrition's product portfolio to include a broader range of plant-based protein bars, aligning with the growing consumer demand for plant-centric alternatives. This development showcased the industry's recognition of the rising popularity of plant-based diets and the importance of offering diverse protein options.

Quest Nutrition's acquisition underscored the broader trend of established companies diversifying their product offerings through strategic acquisitions. This strategic move positioned Quest Nutrition as a key player in the plant-based protein bar segment, highlighting its commitment to staying abreast of dietary trends and catering to evolving consumer preferences.