Sustainability Focus

The Protective Marine Coating Market is increasingly influenced by a growing emphasis on sustainability. As environmental regulations tighten, manufacturers are compelled to develop eco-friendly coatings that minimize harmful emissions and reduce environmental impact. This shift towards sustainable practices is not merely a trend; it is becoming a necessity for compliance with international standards. The market for bio-based and low-VOC (volatile organic compounds) coatings is expanding, as stakeholders seek to align with green initiatives. In 2025, the demand for sustainable marine coatings is projected to account for a substantial portion of the market, reflecting a broader commitment to environmental stewardship. Companies that prioritize sustainability in their product offerings are likely to gain a competitive edge, as consumers increasingly favor environmentally responsible choices.

Regulatory Compliance

Regulatory compliance is a critical driver in the Protective Marine Coating Market. As governments worldwide implement stringent regulations regarding environmental protection and safety standards, manufacturers are compelled to adapt their products accordingly. Compliance with these regulations not only ensures market access but also enhances brand reputation. The demand for coatings that meet specific regulatory requirements is on the rise, as companies seek to avoid penalties and maintain operational licenses. In 2025, the market is likely to see a shift towards coatings that are compliant with international standards, reflecting the industry's commitment to safety and environmental responsibility. This trend may also lead to increased research and development efforts aimed at creating innovative solutions that fulfill regulatory demands.

Technological Advancements

Technological advancements play a pivotal role in shaping the Protective Marine Coating Market. Innovations in coating formulations and application techniques have led to the development of high-performance coatings that offer enhanced durability and protection against harsh marine environments. For instance, the introduction of nanotechnology in coatings has resulted in products that exhibit superior resistance to corrosion and fouling. The market is witnessing a surge in demand for smart coatings that can provide real-time monitoring of the coating's condition, thereby extending the lifespan of marine assets. As of 2025, the integration of advanced technologies is expected to drive market growth, with a notable increase in the adoption of these innovative solutions across various marine applications.

Growing Infrastructure Investment

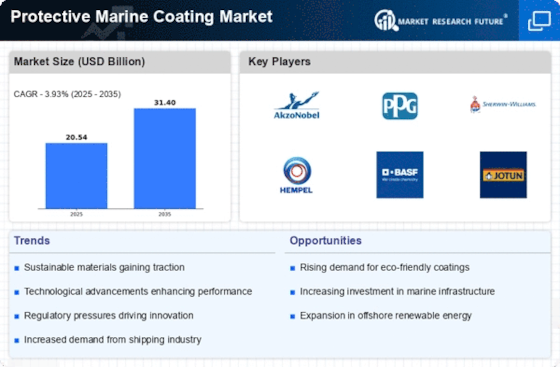

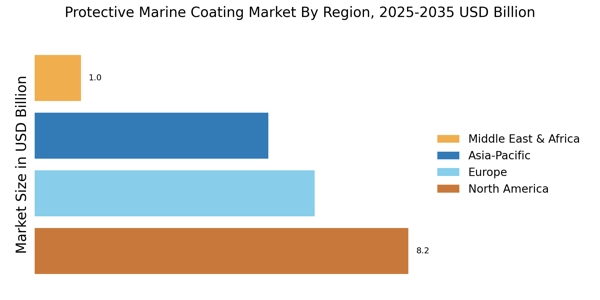

The Protective Marine Coating Market is experiencing a boost due to increasing investments in infrastructure development. Governments and private entities are allocating substantial budgets for the construction and maintenance of marine structures, including ports, ships, and offshore facilities. This trend is particularly evident in regions where maritime trade is a key economic driver. The demand for protective coatings is expected to rise in tandem with these infrastructure projects, as they are essential for safeguarding assets against corrosion and environmental degradation. By 2025, the market is projected to witness a significant uptick in demand, driven by the need for reliable and long-lasting protective solutions in the face of expanding maritime infrastructure.

Rising Demand from Emerging Economies

The Protective Marine Coating Market is witnessing a surge in demand from emerging economies, where rapid industrialization and urbanization are driving growth. As these regions invest in their maritime sectors, the need for protective coatings becomes increasingly pronounced. Emerging markets are focusing on enhancing their shipping and fishing industries, which necessitates the use of high-quality marine coatings to protect vessels and infrastructure. By 2025, it is anticipated that these economies will contribute significantly to the overall market growth, as they seek to modernize their fleets and improve operational efficiency. This trend presents opportunities for manufacturers to expand their reach and cater to the specific needs of these burgeoning markets.