Global Supply Chain Complexity

The complexity of The Product Testing Lab Services Industry. As companies source materials and components from various regions, ensuring product quality and compliance becomes increasingly challenging. This complexity necessitates rigorous testing to identify potential issues before products reach the market. In 2025, the market for supply chain testing services is projected to grow by 12%, driven by the need for enhanced quality control measures. Companies are recognizing that thorough testing can mitigate risks associated with supply chain disruptions, thereby fostering a more resilient operational framework. As a result, the demand for product testing lab services is likely to rise, as businesses seek to maintain high standards throughout their supply chains.

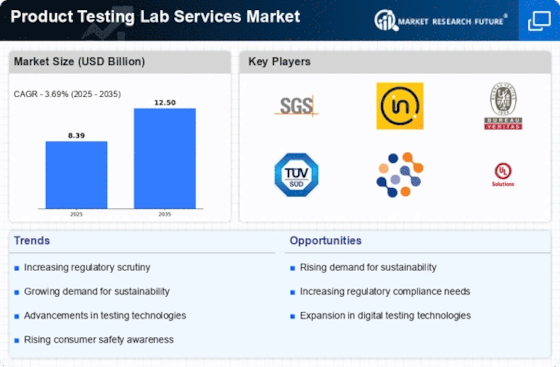

Increasing Regulatory Requirements

The Product Testing Lab Services Market is experiencing a notable surge in demand due to the increasing regulatory requirements imposed by various authorities. As industries such as pharmaceuticals, food and beverages, and consumer goods face stricter compliance standards, the need for reliable testing services becomes paramount. In 2025, it is estimated that the market for compliance testing will reach approximately USD 10 billion, reflecting a compound annual growth rate of around 8%. This trend indicates that companies are prioritizing adherence to regulations, thereby driving the growth of the product testing lab services sector. Furthermore, the emphasis on safety and quality assurance is likely to propel investments in testing services, as businesses seek to mitigate risks associated with non-compliance.

Technological Advancements in Testing

Technological advancements are playing a crucial role in shaping the Product Testing Lab Services Market. The integration of automation, artificial intelligence, and data analytics into testing processes enhances efficiency and accuracy. For instance, the adoption of AI-driven testing methodologies is expected to streamline operations, reducing turnaround times significantly. In 2025, the market for automated testing solutions is projected to grow by 15%, indicating a shift towards more sophisticated testing environments. This evolution not only improves the reliability of test results but also allows laboratories to handle larger volumes of samples, thereby catering to the increasing demand from various sectors. As technology continues to evolve, it is likely that testing labs will increasingly adopt innovative solutions to stay competitive.

Consumer Awareness and Safety Concerns

Consumer awareness regarding product safety and quality is a driving force in the Product Testing Lab Services Market. As consumers become more informed about the potential risks associated with products, they are demanding higher standards of safety and quality assurance. This trend is particularly evident in sectors such as cosmetics, food, and electronics, where product recalls and safety scandals have heightened public scrutiny. In 2025, it is anticipated that the demand for testing services in these sectors will increase by 20%, as companies strive to meet consumer expectations. Consequently, businesses are investing in comprehensive testing protocols to ensure their products are safe for consumption, thereby propelling the growth of the product testing lab services market.

Sustainability and Eco-Friendly Testing Practices

The growing emphasis on sustainability is reshaping the Product Testing Lab Services Market. Companies are increasingly seeking eco-friendly testing practices to align with consumer preferences and regulatory expectations. In 2025, the market for sustainable testing solutions is expected to expand by 10%, reflecting a shift towards environmentally responsible practices. This trend is particularly relevant in industries such as textiles, packaging, and food, where sustainable sourcing and production methods are gaining traction. By adopting eco-friendly testing methodologies, laboratories can not only meet regulatory requirements but also enhance their brand reputation. As sustainability becomes a core value for businesses, the demand for product testing lab services that prioritize environmental considerations is likely to grow.