Emergence of 5G Technology

The emergence of 5G technology is poised to have a transformative impact on the Processor IP Market. With the rollout of 5G networks, there is a growing need for processors that can support higher data rates and lower latency. This technological advancement is expected to drive the demand for advanced processor IP, as telecommunications companies and device manufacturers seek to leverage the capabilities of 5G. Market analysts predict that the 5G infrastructure will require a significant increase in processing power, leading to an estimated growth of 15% in the processor IP segment over the next few years. As a result, the Processor IP Market is likely to see increased investments in research and development to create innovative solutions that can meet the challenges posed by 5G technology.

Expansion of Internet of Things (IoT) Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the Processor IP Market. As more devices become interconnected, the demand for efficient and powerful processors is escalating. It is estimated that the number of IoT devices will reach over 30 billion by 2030, creating a substantial market for processor intellectual property. This growth necessitates the development of specialized processors that can handle the unique requirements of IoT applications, such as low power consumption and real-time data processing. Consequently, companies are increasingly investing in processor IP to create tailored solutions that cater to the specific needs of IoT devices. The Processor IP Market is thus positioned to benefit from this trend, as it provides the essential building blocks for the next generation of smart devices.

Increased Investment in Research and Development

Increased investment in research and development is a critical driver for the Processor IP Market. As technology evolves, companies are allocating more resources to develop innovative processor architectures and designs that can meet the demands of emerging applications. This trend is reflected in the growing number of patents filed in the processor IP space, indicating a robust pipeline of new technologies. Furthermore, industry reports suggest that R&D spending in the semiconductor sector is expected to rise by approximately 12% annually, underscoring the commitment to advancing processor capabilities. This investment is likely to enhance the competitive landscape of the Processor IP Market, as firms strive to create cutting-edge solutions that address the challenges of modern computing.

Rising Focus on Customization and Specialization

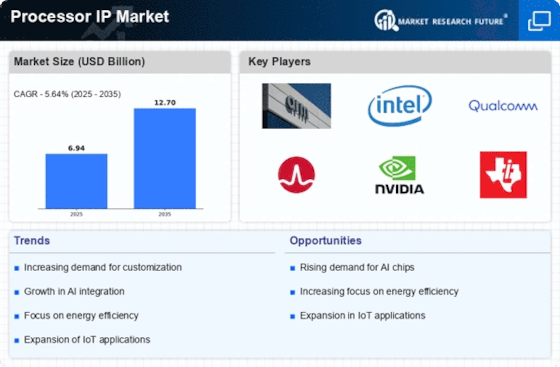

The Processor IP Market is witnessing a rising focus on customization and specialization as companies strive to differentiate their products in a competitive landscape. Manufacturers are increasingly seeking processor IP that can be tailored to meet specific application requirements, whether in consumer electronics, automotive, or industrial sectors. This trend is driven by the need for enhanced performance, energy efficiency, and unique features that cater to niche markets. As a result, the demand for customizable processor IP solutions is expected to grow, with projections indicating a potential increase of 10% in this segment over the next few years. The Processor IP Market is thus adapting to these changing dynamics, fostering innovation and collaboration among IP providers and manufacturers to deliver specialized solutions.

Surge in Demand for Advanced Computing Solutions

The Processor IP Market is experiencing a notable surge in demand for advanced computing solutions, driven by the increasing complexity of applications across various sectors. Industries such as automotive, healthcare, and telecommunications are increasingly relying on sophisticated processing capabilities to enhance performance and efficiency. According to recent data, the demand for high-performance processors is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates a robust market for processor intellectual property, as companies seek to integrate cutting-edge technology into their products. The need for faster, more efficient processing solutions is likely to propel innovation within the Processor IP Market, as firms strive to meet the evolving requirements of their customers.