Growing Health Awareness

As consumers become more health-conscious, there is a growing demand for processed beef products that align with healthier eating habits. The processed beef market is witnessing a shift towards leaner cuts, reduced sodium options, and products fortified with vitamins and minerals. This trend is supported by research indicating that a significant portion of consumers actively seeks out healthier protein sources. In fact, recent surveys reveal that nearly 60% of consumers are willing to pay a premium for healthier processed beef options. This shift not only reflects changing dietary preferences but also presents an opportunity for manufacturers to innovate and cater to the evolving needs of health-focused consumers.

Cultural and Culinary Trends

Cultural and culinary trends significantly influence the processed beef market, as consumers increasingly explore diverse cuisines and flavors. The globalization of food culture has led to a heightened interest in international dishes that incorporate processed beef, such as tacos, stir-fries, and barbecued meats. This trend is reflected in the growing popularity of ethnic food products, which often feature processed beef as a key ingredient. Market analysis shows that the demand for ethnic and fusion foods is expected to grow by approximately 5% annually, providing opportunities for processed beef manufacturers to innovate and expand their product lines to meet these evolving culinary preferences.

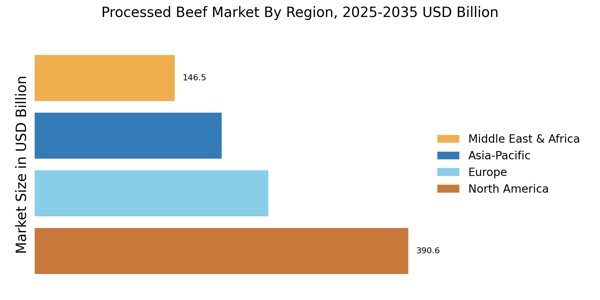

Expansion of Retail Channels

The expansion of retail channels is a significant driver for the processed beef market. With the rise of e-commerce and the increasing presence of specialty food stores, consumers have greater access to a variety of processed beef products. Retailers are diversifying their offerings to include premium and niche products, which cater to specific consumer segments. Data indicates that online grocery sales have surged, with processed beef products being among the top-selling items. This trend is likely to continue, as convenience and accessibility become paramount for consumers. The processed beef market stands to benefit from this expansion, as it allows for broader distribution and increased visibility of products.

Innovations in Product Development

Innovation plays a crucial role in the processed beef market, as manufacturers continuously seek to enhance product offerings. This includes the development of new flavors, textures, and packaging solutions that appeal to diverse consumer preferences. For instance, the introduction of plant-based beef alternatives has gained traction, attracting health-conscious consumers and those seeking sustainable options. Additionally, advancements in preservation techniques have allowed for longer shelf life and improved quality of processed beef products. Market data suggests that innovative product lines can lead to a 15% increase in sales for companies that effectively leverage consumer trends, thereby driving growth within the processed beef market.

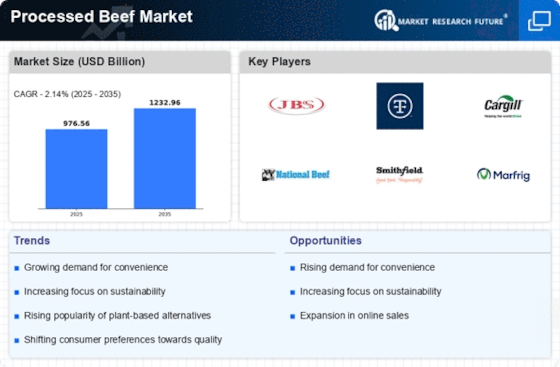

Rising Demand for Convenience Foods

The increasing pace of modern life has led to a notable rise in demand for convenience foods, which includes processed beef products. Consumers are increasingly seeking ready-to-eat meals and quick cooking options that fit their busy lifestyles. This trend is particularly evident in urban areas where time constraints are more pronounced. The processed beef market is responding to this demand by offering a variety of products such as pre-cooked beef patties, beef jerky, and ready-to-cook beef meal kits. According to recent data, the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years, indicating a robust opportunity for processed beef products that cater to this consumer preference.