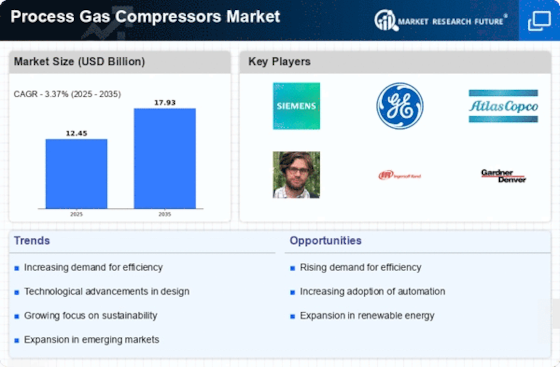

Rising Demand for Natural Gas

The increasing demand for natural gas as a cleaner alternative to coal and oil is a primary driver for the Process Gas Compressors Market. As countries strive to reduce carbon emissions, natural gas is often viewed as a transitional fuel. This shift is evident in various sectors, including power generation and transportation. According to recent data, the natural gas consumption is projected to grow by approximately 1.5% annually, which directly influences the demand for process gas compressors. These compressors are essential for transporting and processing natural gas efficiently, thereby supporting the industry's growth. The Process Gas Compressors Market is likely to benefit from this trend as more investments are made in natural gas infrastructure and related technologies.

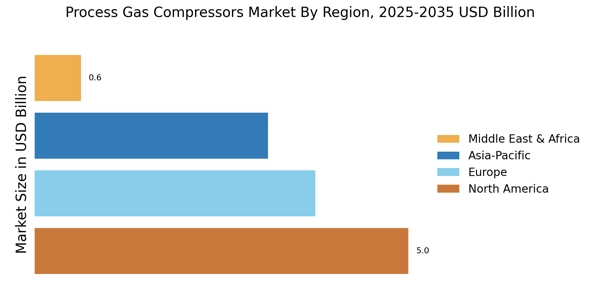

Industrial Growth and Urbanization

The rapid industrial growth and urbanization in emerging economies are significantly impacting the Process Gas Compressors Market. As industries expand, the need for efficient gas handling and processing systems becomes paramount. Urbanization leads to increased energy consumption, necessitating the use of process gas compressors in various applications, including manufacturing and energy production. Data indicates that industrial output in several regions is expected to rise by over 4% annually, further driving the demand for these compressors. The Process Gas Compressors Market is poised to capitalize on this trend, as industries seek to enhance operational efficiency and meet regulatory standards.

Investment in Renewable Energy Projects

Investment in renewable energy projects is emerging as a crucial driver for the Process Gas Compressors Market. As the world transitions towards sustainable energy sources, the integration of natural gas with renewables is becoming increasingly common. Process gas compressors play a vital role in balancing energy supply and demand, particularly in hybrid systems that combine gas and renewable energy sources. Recent reports suggest that investments in renewable energy are expected to exceed USD 2 trillion by 2025, which could lead to a corresponding increase in the demand for process gas compressors. This trend indicates a growing recognition of the importance of these compressors in supporting a more sustainable energy landscape.

Technological Innovations in Compressor Design

Technological innovations in compressor design are significantly influencing the Process Gas Compressors Market. Advances in materials, control systems, and energy efficiency are leading to the development of more sophisticated compressors that can operate under varying conditions. These innovations not only enhance performance but also reduce operational costs, making them attractive to end-users. The market is witnessing a shift towards smart compressors equipped with IoT capabilities, allowing for real-time monitoring and predictive maintenance. This trend is expected to drive the Process Gas Compressors Market forward, as companies seek to leverage technology to improve efficiency and reliability in gas processing.

Regulatory Compliance and Environmental Standards

Regulatory compliance and environmental standards are increasingly shaping the Process Gas Compressors Market. Governments worldwide are implementing stricter regulations aimed at reducing emissions and promoting energy efficiency. These regulations compel industries to adopt advanced gas compression technologies that meet environmental standards. The market is responding to this demand by developing compressors that not only comply with regulations but also enhance operational efficiency. Data indicates that compliance-related investments in the energy sector are projected to reach USD 500 billion by 2025, which will likely drive the demand for process gas compressors. This trend underscores the importance of regulatory frameworks in shaping the future of the Process Gas Compressors Market.