Cost Efficiency

Cost efficiency is emerging as a significant driver for the Process-free CTP Plates Market. The elimination of chemical processing not only reduces operational costs but also minimizes the need for additional equipment and maintenance associated with traditional CTP systems. This financial advantage is particularly appealing to small and medium-sized printing businesses that are looking to optimize their budgets. Furthermore, the long-term savings associated with reduced waste disposal and lower energy consumption contribute to the overall cost-effectiveness of process-free solutions. Market analysis suggests that companies adopting process-free CTP plates can expect a favorable return on investment, which is likely to encourage wider adoption across various segments of the printing industry. As cost considerations become increasingly critical, the Process-free CTP Plates Market is poised for growth driven by the pursuit of economic efficiency.

Quality Improvement

The demand for high-quality print products is a crucial driver for the Process-free CTP Plates Market. Process-free CTP plates are known for their ability to produce sharp images and vibrant colors without the inconsistencies often associated with traditional processing methods. This quality enhancement is particularly important in sectors such as packaging and commercial printing, where visual appeal is paramount. As brands strive to differentiate themselves in a crowded marketplace, the need for superior print quality becomes even more pronounced. Market data indicates that printers utilizing process-free CTP plates report higher customer satisfaction and repeat business due to the enhanced quality of their outputs. This trend suggests that the Process-free CTP Plates Market will continue to thrive as quality remains a top priority for printing companies aiming to meet and exceed client expectations.

Regulatory Compliance

Regulatory compliance is increasingly influencing the dynamics of the Process-free CTP Plates Market. As governments and regulatory bodies implement stricter environmental standards, printing companies are compelled to adapt their processes to remain compliant. Process-free CTP plates offer a viable solution by eliminating the use of harmful chemicals, thus aligning with regulatory requirements. This compliance not only mitigates the risk of penalties but also enhances the reputation of printing firms in the eyes of environmentally conscious consumers. The market landscape indicates that companies prioritizing compliance are more likely to invest in process-free technologies, thereby driving growth in the Process-free CTP Plates Market. As regulations continue to evolve, the demand for compliant printing solutions is expected to rise, further propelling the adoption of process-free CTP plates.

Technological Innovations

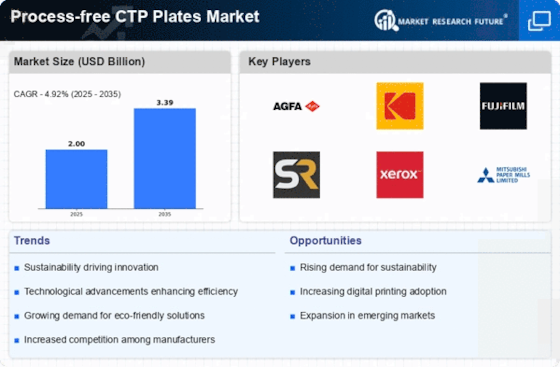

Technological advancements in the printing sector are driving the evolution of the Process-free CTP Plates Market. Innovations in plate manufacturing and imaging technologies have led to the development of high-quality process-free plates that offer superior performance. These advancements enable printers to achieve better resolution and faster production speeds, which are critical in a competitive market. The integration of digital technologies has also streamlined workflows, reducing turnaround times and enhancing overall efficiency. As a result, many printing companies are investing in these advanced technologies to remain competitive. The market data indicates that the adoption of process-free CTP plates is expected to rise, with projections suggesting a substantial increase in market share over the next few years. This trend underscores the importance of technological innovation in shaping the future of the Process-free CTP Plates Market.

Sustainability Initiatives

The increasing emphasis on sustainability within the printing industry appears to be a pivotal driver for the Process-free CTP Plates Market. As environmental regulations tighten, companies are compelled to adopt eco-friendly practices. Process-free CTP plates eliminate the need for chemical processing, thereby reducing waste and harmful emissions. This aligns with the growing consumer demand for sustainable products, which has been reported to influence purchasing decisions significantly. In fact, a notable percentage of printing firms are transitioning to process-free technologies to enhance their environmental credentials. This shift not only meets regulatory requirements but also positions companies favorably in a market that increasingly values sustainability. Consequently, the Process-free CTP Plates Market is likely to experience growth as more businesses seek to align their operations with sustainable practices.