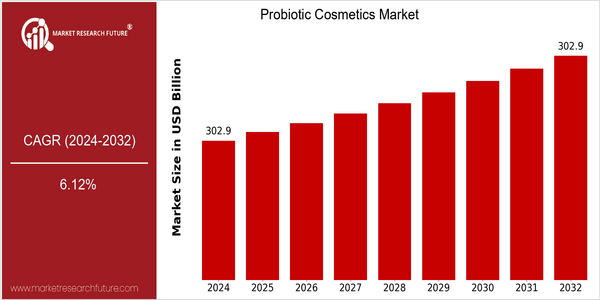

Probiotic Cosmetics Size

Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 302.9 Billion |

| 2032 | USD 302.9 Billion |

| CAGR (2024-2032) | 6.12 % |

Note – Market size depicts the revenue generated over the financial year

A probiotic cosmetics market is expected to reach a market size of $302.94 billion by 2024, which is expected to reach the same level by 2032, registering a CAGR of 6.12% during the forecast period. The growth trend of the market, despite the stability of the market size, is due to the strong demand for probiotic cosmetics. Skin health awareness is growing rapidly in the world, and the benefits of probiotics in maintaining the balance of the skin microbiome are becoming increasingly popular. The clean beauty trend has also contributed to the growth of the market. The development of formulas and delivery systems has also played a key role in the use of probiotics in cosmetics. The market is dominated by three companies: Estée Lauder, L'Oréal, and Procter & Gamble. They are actively investing in research and development, establishing strategic alliances, and launching new products to capture the market. For example, recent collaborations between cosmetics companies and biotechnology companies have resulted in the development of new probiotic formulas. These formulas can help the beauty industry compete more effectively.

Regional Market Size

Regional Deep Dive

Probiotic cosmetics are enjoying significant growth across various regions, as a result of the rising awareness of the benefits of probiotics and the benefits of probiotics in cosmetics. North America is characterised by a strong demand for natural and organic products, while Europe is a market driven by innovation and sustainable development. Asia-Pacific is the fastest growing region, driven by a growing middle class and rising disposable income. In the Middle East and Africa, probiotic cosmetics are being introduced gradually, with a focus on solutions for different skin types. Latin America is also growing rapidly, with an increasing focus on natural and organic products. In each region, the market is characterised by cultural preferences, regulatory frameworks and economic conditions.

Europe

- European consumers are increasingly prioritizing sustainability, leading to innovations in packaging and formulations, with companies like Biotherm launching probiotic-infused products that are eco-friendly.

- The European Union's stringent regulations on cosmetic ingredients are pushing brands to invest in research and development, resulting in more effective and safer probiotic formulations.

Asia Pacific

- The growing influence of K-beauty has popularized probiotic cosmetics in South Korea, with brands like Innisfree and Dr. Jart+ incorporating probiotics into their skincare lines.

- Increased awareness of skin health among consumers in China is driving demand for probiotic cosmetics, with local brands innovating to include traditional ingredients alongside probiotics.

Latin America

- Latin American consumers are increasingly interested in holistic beauty solutions, with brands like Natura &Co leading the way in incorporating probiotics into their product lines.

- The region's diverse climate and skin types are prompting companies to develop probiotic cosmetics that cater specifically to local needs, enhancing market growth potential.

North America

- The rise of clean beauty trends has led to increased demand for probiotic cosmetics, with brands like Tula and Mother Dirt gaining popularity for their focus on skin microbiome health.

- Regulatory changes by the FDA regarding cosmetic labeling have prompted companies to ensure transparency in ingredient sourcing, which is influencing consumer trust and brand loyalty.

Middle East And Africa

- The region is seeing a rise in local brands focusing on natural ingredients, with companies like Kalahari Desert introducing probiotic skincare products tailored to the unique climate and skin types of the region.

- Government initiatives promoting natural and organic cosmetics are encouraging the growth of the probiotic cosmetics market, as consumers seek products that align with their cultural values.

Did You Know?

“Probiotic cosmetics not only aim to improve skin health but also help in balancing the skin's microbiome, which can lead to reduced acne and improved skin hydration.” — Journal of Cosmetic Dermatology

Segmental Market Size

The probiotic cosmetics market is experiencing strong growth, driven by a growing awareness of the benefits of products that support the microbiome. The market is also being driven by the increasing preference for natural ingredients and the increasing number of skin conditions that probiotics can help treat. In addition, the regulatory support for clean beauty is a positive factor for the market, as consumers seek greater transparency in the sourcing and formulation of cosmetics. At present, the market is at a mature stage of development, with companies like Tula and Mother Dirt being at the forefront of probiotic cosmetics. The most common applications are for skin care, hair care and body care. Probiotics are used to enhance the skin barrier and support the microbiome. The growing trend towards sustainable products and the pandemic influenza A/H1N1 further boost the market. Probiotics are used to enhance the skin barrier and help to treat a number of skin conditions. Fermentation and advanced formulation methods are shaping the development of probiotic cosmetics, enabling companies to meet consumer demand for innovation.

Future Outlook

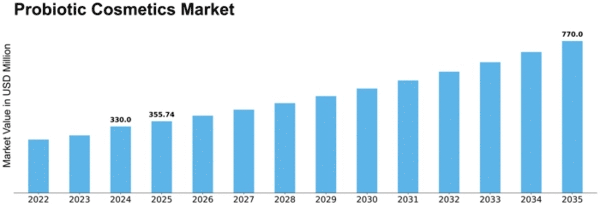

The Probiotics Market is expected to register a CAGR of 6.16% from 2024 to 2032. The market is expected to reach a value of about 302 million dollars in 2032. This will be mainly due to the high demand for products based on the benefits of probiotics for the care and beauty industry. The market is expected to grow significantly, with a potential share of 25 percent of the total cosmetics market by 2032. The growth is mainly driven by developments in biotechnology and the growing body of scientific research on the efficacy of probiotics for improving skin health. This will also lead to a greater demand for probiotics in the care and beauty industry. New formulations are also available that allow for more effective and stable products, which can be used for different skin types and skin problems. Furthermore, the increasing awareness of the microbiome's role in skin health will increase the demand for probiotics in the cosmetics industry and the major cosmetics companies will be investing in probiotics in their cosmetics. Also, the growing regulatory support for natural and organic products will support market growth as consumers move towards products that are consistent with their values of sustainability and safety. The probiotics market is therefore expected to grow steadily as a result of the changing preferences of consumers and the continuous development of new products.

Leave a Comment