Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are contributing to the growth of the Primary Nickel Market. Governments are increasingly investing in infrastructure projects, including transportation, energy, and construction, which require substantial amounts of nickel for various applications. For example, nickel is essential in the production of stainless steel, widely used in construction and infrastructure projects. Recent data suggests that infrastructure spending could rise by 10% annually, creating a robust demand for nickel. This trend indicates that the Primary Nickel Market may see a sustained increase in consumption as these projects unfold. The alignment of infrastructure development with nickel demand could lead to a more stable market environment, benefiting producers and consumers alike.

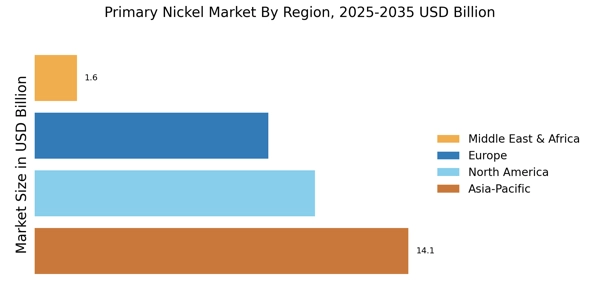

Emerging Economies and Industrial Growth

Emerging economies are witnessing rapid industrial growth, which is significantly impacting the Primary Nickel Market. Countries such as India and Brazil are expanding their manufacturing capabilities, leading to increased consumption of nickel in various sectors, including automotive and construction. The industrial output in these regions is projected to grow by approximately 5% annually, driving the demand for nickel-based products. This growth presents opportunities for nickel producers to tap into new markets and expand their reach. As these economies continue to develop, the Primary Nickel Market is likely to experience a shift in demand dynamics, with emerging markets playing a crucial role in shaping future trends.

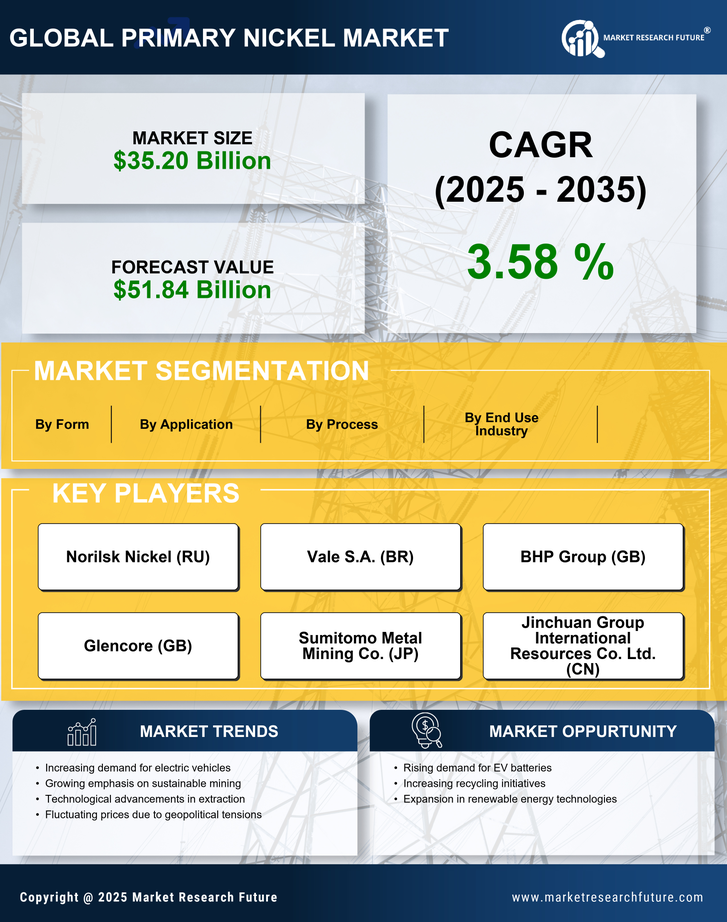

Rising Demand from Battery Manufacturing

The surge in demand for batteries, particularly for electric vehicles and renewable energy storage, is a pivotal driver in the Primary Nickel Market. Nickel is a critical component in lithium-ion batteries, which are increasingly favored for their energy density and efficiency. Recent estimates indicate that the battery sector could account for over 30% of global nickel consumption by 2025. This trend is likely to accelerate as more manufacturers pivot towards electric vehicle production, further propelling the demand for nickel. Consequently, the Primary Nickel Market is expected to experience significant growth, with companies focusing on expanding their production capacities to meet this burgeoning need. The interplay between battery technology advancements and nickel supply dynamics will be crucial in shaping the market landscape.

Technological Advancements in Nickel Production

Technological advancements in nickel production processes are reshaping the Primary Nickel Market. Innovations such as hydrometallurgical techniques and improved smelting methods enhance efficiency and reduce costs. For instance, the implementation of advanced extraction technologies has the potential to increase nickel yield by up to 20%, thereby meeting the rising demand from various sectors. Furthermore, these advancements may lead to a decrease in environmental impact, aligning with global sustainability goals. As the industry evolves, companies that adopt these technologies could gain a competitive edge, positioning themselves favorably in the Primary Nickel Market. The ongoing research and development efforts suggest a promising future for nickel production, potentially leading to a more robust supply chain.

Regulatory Frameworks and Environmental Standards

The evolving regulatory frameworks and environmental standards are influencing the Primary Nickel Market. Governments are implementing stricter regulations aimed at reducing carbon emissions and promoting sustainable practices. These regulations often require industries to adopt cleaner technologies and processes, which can impact nickel production methods. Companies that proactively align with these standards may find themselves at a competitive advantage, as consumers increasingly favor environmentally responsible products. The Primary Nickel Market could see a shift towards more sustainable practices, potentially affecting supply chains and production costs. As regulations continue to evolve, the industry must adapt to maintain compliance while meeting the growing demand for nickel.