North America : Market Leader in PM Services

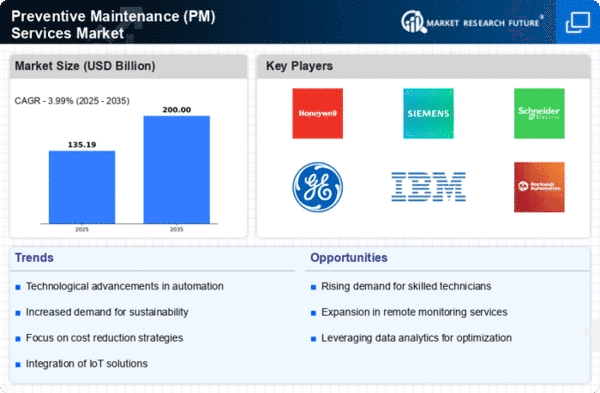

North America is poised to maintain its leadership in the Preventive Maintenance (PM) Services Market, holding a significant 65.0% share. The region's growth is driven by advanced technology adoption, stringent regulatory frameworks, and a focus on operational efficiency. Industries are increasingly investing in predictive analytics and IoT solutions to enhance maintenance strategies, thereby reducing downtime and costs. The competitive landscape is robust, with key players like Honeywell, General Electric, and IBM leading the charge. The U.S. is the primary market, supported by a strong manufacturing base and technological innovation. Companies are leveraging digital transformation to optimize maintenance processes, ensuring they remain at the forefront of the PM services sector.

Europe : Emerging Trends in PM Services

Europe is witnessing a growing demand for Preventive Maintenance (PM) Services, capturing a 35.0% market share. The region's growth is fueled by increasing regulatory requirements aimed at enhancing safety and efficiency in industrial operations. Countries are investing in sustainable practices and digital technologies, which are pivotal in driving the adoption of PM services across various sectors. Germany and France are leading the charge, with significant contributions from key players like Siemens and Schneider Electric. The competitive landscape is characterized by innovation and collaboration, as companies seek to integrate advanced technologies into their service offerings. The European market is expected to continue evolving, driven by a commitment to sustainability and operational excellence.

Asia-Pacific : Rapid Growth in PM Services

The Asia-Pacific region is emerging as a significant player in the Preventive Maintenance (PM) Services Market, holding a 25.0% share. Rapid industrialization, urbanization, and technological advancements are key drivers of this growth. Governments are increasingly focusing on infrastructure development and smart city initiatives, which are catalyzing the demand for efficient maintenance solutions across various sectors. China and Japan are at the forefront, with major companies like Mitsubishi Electric leading the market. The competitive landscape is evolving, with local players also gaining traction. As industries adopt IoT and AI technologies, the PM services market in Asia-Pacific is expected to expand, driven by the need for enhanced operational efficiency and reduced downtime.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region represents a nascent but promising market for Preventive Maintenance (PM) Services, with a modest 5.0% share. The growth is primarily driven by increasing investments in infrastructure and industrial sectors, alongside a rising awareness of the benefits of preventive maintenance. Governments are implementing policies to enhance operational efficiency, which is expected to further stimulate market growth. Countries like the UAE and South Africa are leading the way, with a growing presence of international players. The competitive landscape is gradually evolving, as local companies begin to adopt advanced maintenance technologies. As the region continues to develop, the demand for PM services is anticipated to rise, driven by the need for improved reliability and efficiency in operations.