Government Initiatives and Support

Government initiatives and support are instrumental in fostering growth within the Global Prefabrication Market Industry. Various countries are implementing policies that promote the use of prefabricated construction methods, recognizing their potential to address housing shortages and improve construction efficiency. Incentives such as tax breaks and grants for sustainable building practices further encourage the adoption of prefabrication. These supportive measures are likely to stimulate market expansion, as evidenced by the anticipated growth trajectory of the industry. The alignment of governmental objectives with the benefits of prefabrication positions the Global Prefabrication Market Industry for continued success.

Cost Efficiency and Labor Shortages

Cost efficiency remains a critical driver for the Global Prefabrication Market Industry. As construction costs rise, prefabrication presents a solution by minimizing material waste and reducing labor requirements. The streamlined processes associated with prefabricated construction can lead to significant savings, appealing to developers and contractors alike. Additionally, the construction sector faces labor shortages, making prefabrication an attractive alternative that mitigates these challenges. The industry's ability to deliver projects on time and within budget enhances its competitiveness, suggesting a favorable outlook for the Global Prefabrication Market Industry in the coming years.

Rising Demand for Sustainable Construction

The Global Prefabrication Market Industry experiences a notable increase in demand for sustainable construction practices. As environmental concerns escalate, stakeholders are increasingly seeking eco-friendly building solutions. Prefabrication Market offers reduced waste and energy efficiency, aligning with global sustainability goals. For instance, the use of prefabricated materials can lead to a decrease in carbon emissions during construction. This shift towards sustainability is reflected in the projected market growth, with the industry expected to reach 224.6 USD Billion in 2024. Such trends indicate a robust commitment to environmentally responsible building practices, positioning the Global Prefabrication Market Industry favorably in the evolving construction landscape.

Urbanization and Infrastructure Development

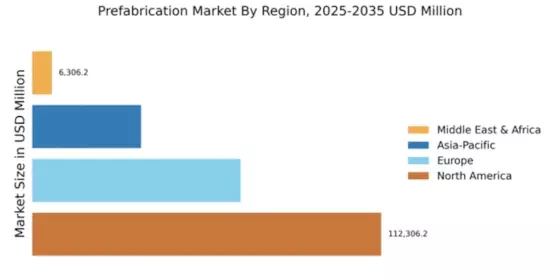

The ongoing trend of urbanization significantly influences the Global Prefabrication Market Industry. Rapid population growth in urban areas necessitates the development of efficient housing and infrastructure solutions. Prefabrication Market offers a viable response to these demands, enabling quicker construction timelines and cost-effective building methods. Governments worldwide are investing in infrastructure projects, further propelling the adoption of prefabricated solutions. This trend is expected to contribute to a compound annual growth rate of 5.62% from 2025 to 2035, underscoring the potential of the Global Prefabrication Market Industry to meet the challenges posed by urbanization.

Technological Advancements in Prefabrication

Technological innovations play a pivotal role in shaping the Global Prefabrication Market Industry. Advances in manufacturing processes, such as 3D printing and modular construction techniques, enhance efficiency and precision in prefabricated components. These technologies facilitate faster assembly and reduce labor costs, making prefabrication an attractive option for developers. As a result, the industry is poised for substantial growth, with projections indicating a market size of 409.9 USD Billion by 2035. The integration of smart technologies further enhances the appeal of prefabricated structures, suggesting a transformative impact on construction methodologies within the Global Prefabrication Market Industry.