Emphasis on Cost-Effectiveness

Cost-effectiveness remains a critical driver in the Pre-Terminated System Market. Organizations are increasingly focused on reducing operational expenses while maintaining high-quality standards. Pre-terminated systems provide a cost-efficient alternative to traditional cabling solutions, as they require less labor and time for installation. This financial advantage is particularly appealing to businesses operating on tight budgets or those looking to maximize their return on investment. As the market continues to evolve, the emphasis on cost-effectiveness is expected to drive further adoption of pre-terminated systems across various sectors.

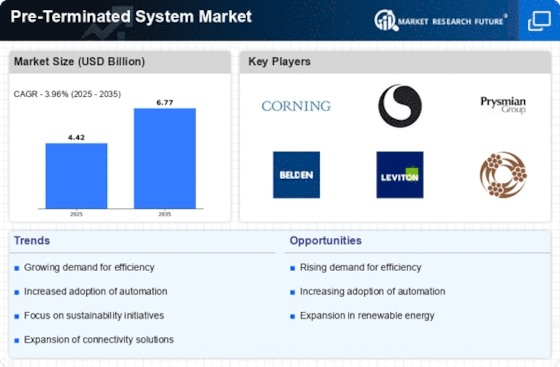

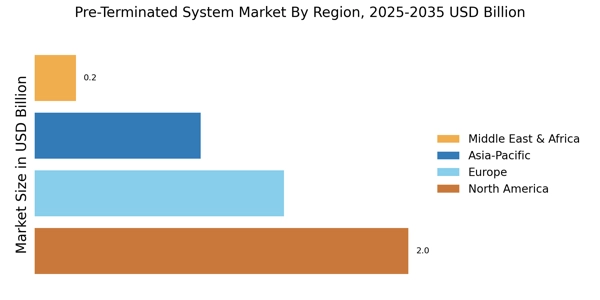

Rising Infrastructure Investments

The Pre-Terminated System Market is experiencing a surge in infrastructure investments across various sectors, including telecommunications, data centers, and commercial buildings. Governments and private entities are allocating substantial budgets to enhance connectivity and efficiency. For instance, the telecommunications sector is projected to witness a compound annual growth rate of approximately 6.5% over the next five years, driving demand for pre-terminated systems that facilitate rapid deployment and scalability. This trend indicates a robust market potential as stakeholders seek to optimize their infrastructure with advanced solutions.

Regulatory Compliance and Standards

The Pre-Terminated System Market is influenced by the need for compliance with regulatory standards and industry guidelines. As governments and organizations implement stricter regulations regarding data security and network performance, the demand for compliant pre-terminated systems is likely to increase. These systems are designed to meet various standards, ensuring that installations adhere to safety and performance requirements. This focus on compliance not only enhances the credibility of the products but also drives market growth as companies prioritize adherence to regulations in their infrastructure projects.

Growing Need for Efficient Installation

In the Pre-Terminated System Market, the demand for efficient installation processes is becoming increasingly pronounced. As projects become more complex, the need for systems that can be installed quickly and with minimal labor is paramount. Pre-terminated systems offer a streamlined solution, reducing installation time by up to 50% compared to traditional methods. This efficiency not only lowers labor costs but also minimizes project delays, making these systems highly attractive to contractors and project managers. The market is likely to expand as more companies recognize the benefits of adopting these innovative solutions.

Technological Advancements in Connectivity

Technological advancements are playing a pivotal role in shaping the Pre-Terminated System Market. Innovations in fiber optic technology and modular design are enhancing the performance and reliability of pre-terminated systems. As data transmission speeds increase and the demand for high-bandwidth applications rises, these systems are becoming essential for modern infrastructure. The market is projected to grow as organizations seek to leverage these advancements to improve their network capabilities. Furthermore, the integration of smart technologies is likely to further propel the adoption of pre-terminated systems, aligning with the industry's evolution.