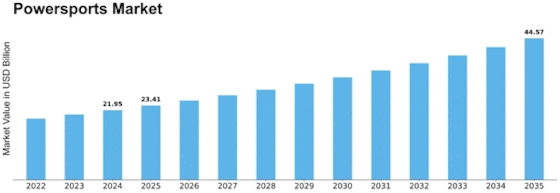

Powersports Size

Powersports Market Growth Projections and Opportunities

Sales of ATVs, UTVs, and motorcycles are predicted to experience significant growth, thanks to rapid technological advancements in these products. Major players in North America, such as Honda Motor Co., Ltd., and Yamaha Motor Co., Ltd, are concentrating on product development to attract more customers. For example, in 2018, Honda Motor Co., Ltd introduced the 2019 Side-by-Side/ATV Models TRX 250X and TRX90X. Similarly, during the same year, Yamaha Motor Co., Ltd launched a new mid-class ATV, the 2019 Kodiak 450, featuring a four-stroke, two-valve, liquid-cooled SOHC 421 cc engine. Moreover, manufacturers of powersport products are expanding their presence in the US, Canada, and Mexico by establishing bases in these countries.

The thriving tourism industry and the increasing number of experience zones are anticipated to stimulate the production of powersports and components. Key manufacturers in North America are making substantial investments in developing various products and aftermarket services to enrich their product portfolio and gain a competitive advantage over their peers in the market. In conclusion, it can be inferred that innovation in powersports products is poised to generate growth opportunities for players in the North America powersports market throughout the forecast period.

The powersports industry in North America is witnessing a surge in product development, with companies like Honda and Yamaha leading the way. These developments aim to offer consumers advanced and exciting options in ATVs, UTVs, and motorcycles. For instance, Honda's introduction of the 2019 Side-by-Side/ATV Models TRX 250X and TRX90X and Yamaha's launch of the 2019 Kodiak 450 showcase the commitment to technological innovation and meeting the diverse needs of riders.

Furthermore, the strategic focus on expanding manufacturing and operational bases in the US, Canada, and Mexico reflects the industry's acknowledgment of the growing market in North America. Establishing a local presence allows these companies to cater more efficiently to the needs of the regional market, fostering growth and competitiveness.

The tourism sector's upward trajectory in North America plays a pivotal role in driving the demand for powersports vehicles. The industry's growth, coupled with the rising popularity of experience zones, creates a favorable environment for increased production of powersports and related components. Manufacturers are recognizing this trend and directing their investments towards product diversification and aftermarket services, ensuring they remain at the forefront of market competition.

In essence, the North America powersports market is not only witnessing technological advancements and product innovations but also benefiting from a strategic expansion of manufacturing capabilities. These efforts collectively contribute to an optimistic outlook for the industry, presenting new opportunities for growth and market leadership in the coming years.

Leave a Comment