Evolving Consumer Preferences

Consumer preferences in the Powersports Apparel Market are evolving, with a noticeable shift towards high-quality, durable, and stylish apparel. Today's consumers are increasingly discerning, seeking products that not only provide safety but also reflect their personal style and identity. This trend is supported by market data indicating that premium apparel segments are experiencing growth, as consumers are willing to invest in higher-priced items that offer better performance and aesthetics. Additionally, the rise of social media and influencer marketing has amplified the visibility of various apparel brands, further shaping consumer choices. As a result, manufacturers are compelled to adapt their offerings to align with these changing preferences, which may include collaborations with popular brands or the introduction of limited-edition collections.

Growth of E-commerce and Online Retail

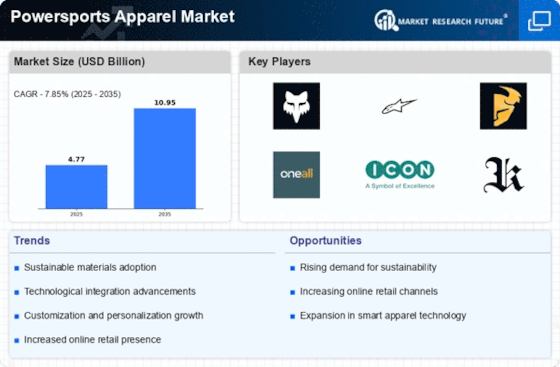

The growth of e-commerce and online retail platforms is significantly impacting the Powersports Apparel Market. As consumers increasingly turn to online shopping for convenience and variety, apparel brands are expanding their digital presence to capture this market segment. Recent statistics indicate that online sales of powersports apparel have surged, driven by the ease of access to a wide range of products and competitive pricing. This shift towards online retail not only allows consumers to compare products easily but also provides brands with valuable data on consumer preferences and buying behaviors. Consequently, manufacturers are likely to invest in enhancing their online platforms and digital marketing strategies to engage with consumers effectively and drive sales.

Increased Focus on Safety and Protection

An increased focus on safety and protection is a significant driver in the Powersports Apparel Market. As awareness of the risks associated with powersports activities grows, consumers are prioritizing apparel that offers enhanced safety features. This trend is reflected in market data, which shows a rising demand for protective gear, such as reinforced jackets, helmets, and gloves. Manufacturers are responding by developing apparel that meets stringent safety standards while also incorporating stylish designs. This dual focus on safety and aesthetics is likely to appeal to a broader audience, including new riders who may be more cautious about their safety. As a result, the emphasis on safety is expected to continue driving innovation and growth within the market.

Technological Innovations in Apparel Design

Technological innovations are playing a crucial role in shaping the Powersports Apparel Market. Advancements in materials and manufacturing processes have led to the development of apparel that is not only more protective but also lighter and more comfortable. For instance, the integration of moisture-wicking fabrics and impact-resistant materials has become increasingly common, enhancing the overall user experience. Market data suggests that the demand for technologically advanced apparel is on the rise, as consumers prioritize functionality alongside style. Furthermore, the incorporation of smart technologies, such as built-in communication devices or GPS tracking, is likely to attract tech-savvy riders. This trend indicates that manufacturers must stay abreast of technological advancements to remain competitive and meet the evolving needs of consumers.

Rising Participation in Powersports Activities

The increasing participation in powersports activities, such as motocross, ATV riding, and snowmobiling, appears to be a primary driver for the Powersports Apparel Market. As more individuals engage in these recreational activities, the demand for specialized apparel that offers protection, comfort, and style is likely to rise. According to recent data, the number of participants in powersports has shown a steady increase, with millions of enthusiasts worldwide. This trend suggests that manufacturers may need to expand their product lines to cater to a diverse audience, including women and younger riders. Consequently, the growth in participation not only fuels the demand for apparel but also encourages innovation in design and functionality, thereby enhancing the overall market landscape.

Leave a Comment