Rising Energy Consumption

The Global Power T&D Equipment Market Industry is significantly impacted by the rising global energy consumption. As economies grow and populations increase, the demand for electricity continues to rise, necessitating the expansion of power transmission and distribution networks. The International Energy Agency projects that global electricity demand will increase by 30% by 2040, which will require substantial investments in T&D infrastructure. This trend underscores the importance of modernizing existing systems and developing new technologies to meet future energy needs. Consequently, the market is poised for sustained growth, with a stable valuation of 172.4 USD Billion expected by 2024.

Government Policies and Regulations

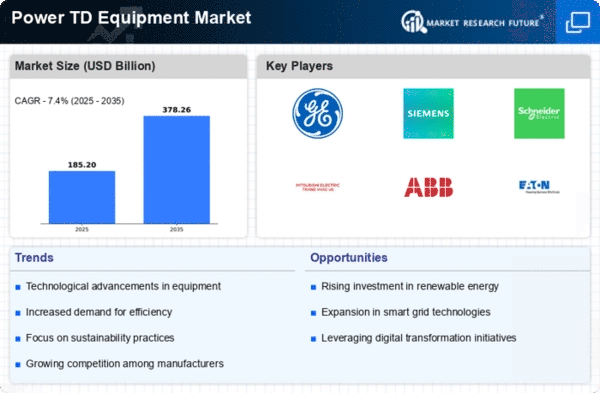

Government policies and regulations significantly influence the Global Power T&D Equipment Market Industry. Many countries are implementing stringent regulations aimed at improving energy efficiency and reducing environmental impacts. For instance, the European Union's Green Deal aims to make Europe climate-neutral by 2050, which includes substantial investments in T&D infrastructure. Such policies create a favorable environment for T&D equipment manufacturers, as utilities are compelled to upgrade their systems to comply with new standards. This regulatory landscape not only drives demand for innovative solutions but also positions the market for steady growth, with a projected CAGR of 0.0% for 2025-2035.

Increasing Demand for Renewable Energy

The Global Power T&D Equipment Market Industry experiences a notable surge in demand for renewable energy sources, driven by global initiatives to reduce carbon emissions. Governments worldwide are investing heavily in solar, wind, and hydroelectric power, necessitating advanced transmission and distribution equipment to efficiently manage these energy sources. For instance, the International Renewable Energy Agency reports that renewable energy capacity is expected to reach 4,000 GW by 2030, which will require significant upgrades in T&D infrastructure. This shift not only supports sustainability goals but also enhances the market's growth potential, as the industry adapts to accommodate diverse energy inputs.

Technological Advancements in T&D Equipment

Technological innovations play a pivotal role in shaping the Global Power T&D Equipment Market Industry. The integration of smart grid technologies, automation, and digitalization enhances the efficiency and reliability of power transmission and distribution systems. For example, the deployment of advanced metering infrastructure allows for real-time monitoring and management of energy flows, reducing losses and improving service quality. As utilities adopt these technologies, the market is likely to witness increased investments, with projections indicating a stable market value of 172.4 USD Billion by 2024. This trend suggests a robust future for T&D equipment as utilities modernize their infrastructure.

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are key drivers of the Global Power T&D Equipment Market Industry. As populations migrate to urban areas, the demand for reliable electricity supply escalates, necessitating the expansion and enhancement of T&D networks. According to the United Nations, urban areas are expected to house 68% of the global population by 2050, which will require substantial investments in power infrastructure. This urban growth presents opportunities for T&D equipment manufacturers to provide solutions that meet the increasing energy demands of densely populated regions, potentially stabilizing the market value at 172.4 USD Billion by 2035.