Research Methodology on Power Rental Market

Power rental market research is the process of gathering, documenting, and analyzing information to support decision-making and gain strategic insights. This research methodology focuses on the sources and techniques used to understand and quantify the power rental market.

1. Research Objectives

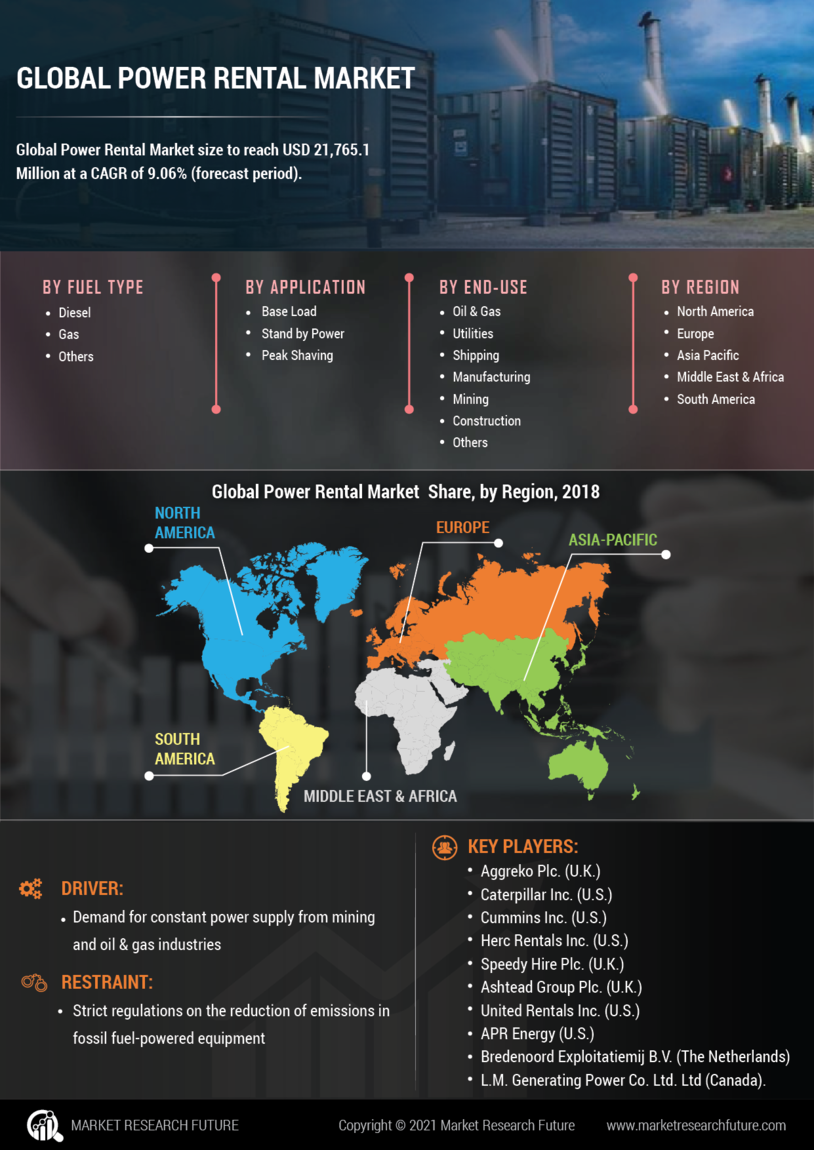

The objective of this research is to estimate the size, dynamics, and regional aspects of the power rental market and analyze its overall impact on the industry.

2. Data Collection

Data for this research is collected from various sources such as primary interviews, secondary research, and industry databases. Primary research is conducted with stakeholders in the industry, such as manufacturers and suppliers, along with key industry experts.

Primary interviews were conducted and questions related to market size, structure, and dynamics were asked. Secondary research is conducted using industry publications, company annual reports, and other reliable sources. Industry databases such as World Bank and Energy Information Administration were used to gain knowledge on global market dynamics.

3. Research Model

The research model used for this report is based on the Global Power Guidelines developed by the International Energy Agency (IEA). This model contains four components: demand and supply analysis, market forecasting, policy evaluation, and financing assessment.

The demand and supply analysis involves the estimation of current and future demand for different power resources and the availability of these resources. Market forecasting includes market share analysis, segment outlook, and growth outlook. The policy evaluation includes analyzing the impact of regulations on power rental markets. The financing assessment includes evaluating the impact of public and private funding sources on power rental markets.

4. Segmentation

The research report has been segmented into three components: by type, by application, and by region.

By Type: The power rental market has been segmented into diesel, gasoline, and other.

By Application: The power rental market has been segmented into construction, agriculture, mining, oil & gas, and others.

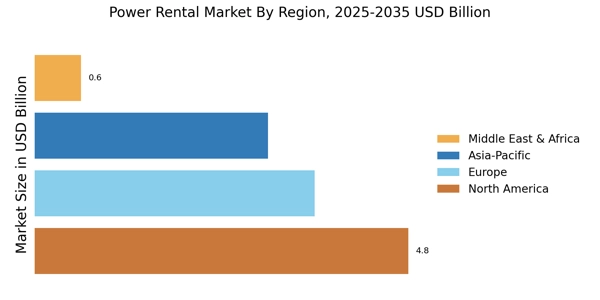

By Region: The report has been segmented into Europe, Asia-Pacific, North America, and the Rest of the World.

5. Assumptions

Assumptions made during the research include forecasted growth in the power rental industry and the potential impact of high growth on the power rental market. It has also assumed that the rate of growth in the industry will remain in line with the industry's historical trends.

6. Research Approach

The research approach adopted for the preparation of this report is powered by a mix of top-down and bottom-up approaches. The top-down approach to estimating the size of the power rental market is used to get an understanding of the overall size of the market. This is done by taking into consideration various data sources such as existing databases and internal/external sources. The bottom-up approach is employed to verify the accuracy of the data obtained from the top-down approach.

7. Statistical Model

The statistical model used for this research includes regression analysis and time series analysis. Regression analysis is used to study the relationship between different variables and to analyze the impact of various factors on the power rental market. Time series analysis was used to study the variations in the market between different years.

8. Data Analysis

The collected data is organized and analyzed using quantitative and qualitative methods. The quantitative methods include forecasting and trend analysis, whereas qualitative methods included market segmentation and SWOT analysis. Data analysis is conducted using SPSS software to analyze the power rental market from the present to the future.

9. Final Result

After completing the research and assessing the data, the report is generated outlining the power rental market’s regional, country-level, and global market size, segments, competition analysis, current and historical trends, bargaining power of buyers/suppliers, opportunity analysis, and Porter’s Five Forces Model. The report also contains interpretation and insights regarding the dynamics of the power rental market.