North America : Market Leader in Services

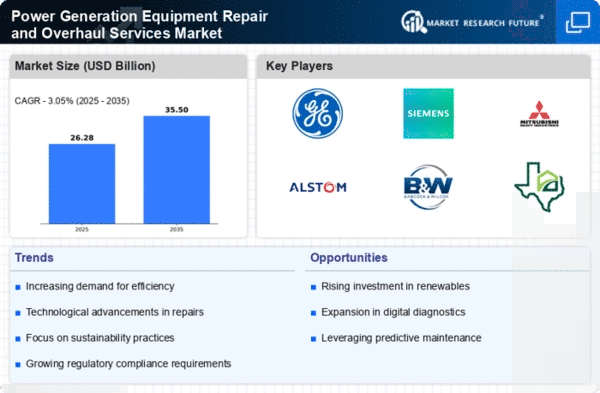

North America is poised to maintain its leadership in the Power Generation Equipment Repair and Overhaul Services Market, holding a market size of $12.75 billion in 2025. Key growth drivers include increasing energy demands, aging infrastructure, and stringent regulatory frameworks aimed at enhancing operational efficiency. The region's focus on renewable energy sources is also catalyzing investments in repair and overhaul services, ensuring compliance with environmental standards. The competitive landscape is characterized by major players such as General Electric, Siemens, and Babcock & Wilcox, which dominate the market. The U.S. and Canada are the leading countries, benefiting from advanced technological capabilities and substantial investments in energy infrastructure. The presence of these key players ensures a robust service network, catering to diverse customer needs across various sectors.

Europe : Regulatory-Driven Market Growth

Europe's Power Generation Equipment Repair and Overhaul Services Market is projected to reach $7.5 billion by 2025, driven by stringent regulations and a strong commitment to sustainability. The European Union's Green Deal and various national policies are pushing for cleaner energy solutions, which in turn increases the demand for repair and overhaul services. This regulatory environment fosters innovation and investment in modernizing existing power generation facilities. Leading countries in this region include Germany, France, and the UK, where companies like Siemens and Alstom are key players. The competitive landscape is marked by a focus on technological advancements and partnerships aimed at enhancing service offerings. The presence of established firms ensures a comprehensive service network, addressing the growing needs of the energy sector.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing significant growth in the Power Generation Equipment Repair and Overhaul Services Market, projected to reach $4.5 billion by 2025. Key drivers include rapid industrialization, urbanization, and increasing energy consumption across countries like China and India. Government initiatives aimed at enhancing energy security and efficiency are also contributing to the rising demand for repair and overhaul services in this region. China and India are the leading countries, with a competitive landscape featuring both local and international players. Companies like Mitsubishi Heavy Industries and Doosan Heavy Industries are expanding their service capabilities to meet the growing market needs. The region's focus on renewable energy sources is further driving investments in service infrastructure, ensuring a sustainable energy future.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the Power Generation Equipment Repair and Overhaul Services Market, with a projected size of $0.75 billion by 2025. The growth is primarily driven by increasing energy demands and investments in infrastructure development. Governments are focusing on diversifying energy sources and enhancing operational efficiencies, which are crucial for the region's economic growth and energy security. Leading countries include the UAE and South Africa, where the competitive landscape is evolving with the entry of new players and partnerships. Companies are increasingly investing in local service capabilities to cater to the unique needs of the region. The presence of key players is essential for developing a robust service network that can support the growing energy sector.