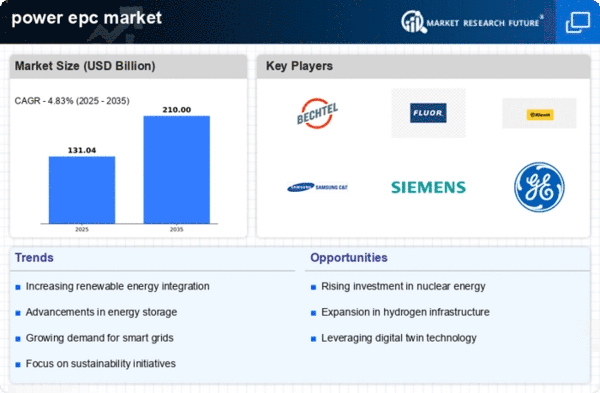

North America : Market Leader in Power EPC

North America continues to lead the power EPC market, holding a significant market share of 50.0 in 2024. The region's growth is driven by increasing investments in renewable energy, infrastructure upgrades, and regulatory support for sustainable practices. The demand for efficient energy solutions is further fueled by government initiatives aimed at reducing carbon emissions and enhancing energy security. The competitive landscape is characterized by major players such as Bechtel, Fluor Corporation, and General Electric, which dominate the market with their extensive experience and technological capabilities. The U.S. remains the largest contributor, while Canada is also emerging as a key player in renewable energy projects. The presence of these industry giants ensures a robust market environment, fostering innovation and efficiency.

Europe : Emerging Powerhouse in Energy

Europe's power EPC market is poised for growth, with a market size of 35.0 in 2024. The region is heavily influenced by stringent environmental regulations and ambitious sustainability goals set by the European Union. Investments in renewable energy sources, such as wind and solar, are driving demand for EPC services, supported by government incentives and funding programs aimed at achieving carbon neutrality by 2050. Leading countries like Germany, France, and the UK are at the forefront of this transformation, with key players such as Siemens AG and Toshiba Corporation actively participating in large-scale projects. The competitive landscape is marked by a focus on innovation and collaboration, as companies seek to leverage advanced technologies to enhance project efficiency and reduce costs. The commitment to sustainability is reshaping the market dynamics significantly.

Asia-Pacific : Rapid Growth in Energy Sector

The Asia-Pacific region is witnessing rapid growth in the power EPC market, with a market size of 30.0 in 2024. This growth is primarily driven by increasing energy demands from developing economies, urbanization, and government initiatives to enhance energy infrastructure. Countries are investing heavily in renewable energy projects to meet both domestic needs and international climate commitments, creating a favorable environment for EPC services. China and India are leading the charge, with significant investments in solar and wind energy projects. Key players like Samsung C&T and Jacobs Engineering are capitalizing on these opportunities, contributing to a competitive landscape that emphasizes innovation and efficiency. The region's diverse energy needs and regulatory frameworks present both challenges and opportunities for market participants, making it a dynamic environment for growth.

Middle East and Africa : Resource-Rich Frontier for Energy

The Middle East and Africa region, with a market size of 10.0 in 2024, presents a unique opportunity in the power EPC market. The region is rich in natural resources, and there is a growing emphasis on diversifying energy sources beyond fossil fuels. Governments are increasingly investing in renewable energy projects to meet rising energy demands and to align with global sustainability trends, creating a favorable landscape for EPC services. Countries like the UAE and South Africa are leading the way, with significant investments in solar and wind energy initiatives. The competitive landscape includes both local and international players, with companies looking to leverage the region's resources and expertise. The focus on infrastructure development and energy diversification is expected to drive growth in the coming years, making this region a key player in The power epc market.