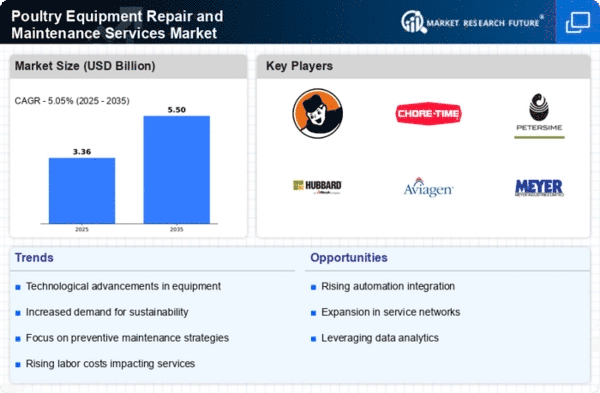

The Poultry Equipment Repair and Maintenance Services Market is characterized by a competitive landscape that is increasingly shaped by innovation, strategic partnerships, and a focus on sustainability. Key players such as Big Dutchman (DE), Chore-Time (US), and Petersime (BE) are actively enhancing their operational capabilities to meet the evolving demands of poultry producers. These companies are not only investing in advanced technologies but are also exploring mergers and acquisitions to bolster their market positions. The collective strategies of these firms indicate a trend towards a more integrated and technologically advanced service offering, which is likely to redefine competitive dynamics in the market.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance service delivery and reduce operational costs. The market appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they set benchmarks for quality and service standards that smaller firms often strive to meet. This competitive structure fosters an environment where innovation and efficiency are paramount, compelling all players to adapt swiftly to market changes.

In November Big Dutchman (DE) announced the launch of a new digital maintenance platform aimed at streamlining service requests and enhancing customer engagement. This strategic move is indicative of the company's commitment to digital transformation, which not only improves operational efficiency but also strengthens customer relationships by providing real-time support and insights. Such initiatives are likely to position Big Dutchman as a leader in the digitalization of poultry equipment services.

In October Chore-Time (US) expanded its service network by partnering with local repair firms across North America. This strategic alliance is designed to enhance service accessibility and response times for customers, thereby improving overall satisfaction. By leveraging local expertise, Chore-Time is not only optimizing its service delivery but also reinforcing its market presence in a highly competitive environment.

In September Petersime (BE) unveiled a new line of energy-efficient incubators, which are designed to reduce energy consumption by up to 30%. This innovation aligns with the growing emphasis on sustainability within the poultry industry. By prioritizing energy efficiency, Petersime is not only addressing environmental concerns but also appealing to cost-conscious producers looking to reduce operational expenses.

As of December the competitive trends in the Poultry Equipment Repair and Maintenance Services Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing service offerings and expanding market reach. Looking ahead, it is anticipated that competitive differentiation will increasingly pivot from price-based strategies to those centered on innovation, technological advancement, and supply chain reliability. This shift underscores the necessity for companies to remain agile and responsive to the dynamic needs of the poultry industry.