Supportive Policy Frameworks

Supportive policy frameworks established by governments and health organizations are instrumental in fostering the Global Postpartum Depression Drug Market Industry. Policies aimed at improving maternal mental health care, including funding for research and access to treatment, create a conducive environment for market growth. Initiatives that promote screening and early intervention for postpartum depression are particularly impactful, as they encourage timely treatment and reduce stigma. As the market evolves, these supportive policies are likely to enhance the accessibility and affordability of postpartum depression drugs, contributing to the anticipated growth of the industry in the coming years.

Increased Healthcare Expenditure

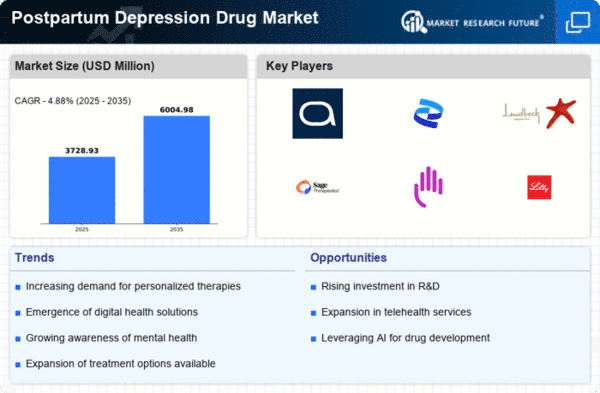

The rise in healthcare expenditure globally is a crucial factor propelling the Global Postpartum Depression Drug Market Industry. Governments and private sectors are investing more in mental health services, recognizing the importance of addressing postpartum depression. This increase in funding facilitates access to medications and treatment programs, thereby encouraging more women to seek help. As healthcare systems evolve, the integration of mental health into maternal care is becoming more pronounced. The projected compound annual growth rate of 4.89% from 2025 to 2035 indicates a robust market response to these financial commitments, ultimately benefiting patients and healthcare providers alike.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the Global Postpartum Depression Drug Market Industry. Tailoring treatments to individual patient profiles enhances therapeutic efficacy and minimizes adverse effects, which is particularly important in managing postpartum depression. As genetic and biomarker research advances, the potential for customized drug therapies increases, allowing for more effective management of symptoms. This trend aligns with the broader movement in healthcare towards individualized treatment plans. The market's growth trajectory, projected to reach 6 USD Billion by 2035, suggests that personalized approaches will play a significant role in addressing the diverse needs of postpartum patients.

Rising Awareness of Postpartum Depression

The increasing awareness surrounding postpartum depression is a pivotal driver for the Global Postpartum Depression Drug Market Industry. Educational campaigns and advocacy efforts by healthcare organizations have led to heightened recognition of the condition among new mothers. This awareness encourages women to seek treatment, thereby expanding the market for postpartum depression drugs. As of 2024, the market is valued at approximately 3.55 USD Billion, reflecting the growing demand for effective therapeutic options. The emphasis on mental health in maternal care is likely to continue, potentially increasing the market's growth trajectory in the coming years.

Advancements in Pharmacological Treatments

Innovations in pharmacological treatments for postpartum depression are significantly influencing the Global Postpartum Depression Drug Market Industry. Recent developments in drug formulations and delivery methods have improved efficacy and reduced side effects, making treatments more appealing to patients. For instance, the introduction of novel antidepressants specifically targeting postpartum symptoms has shown promise in clinical trials. This advancement not only enhances patient outcomes but also drives market growth, as healthcare providers are more inclined to prescribe these new therapies. The anticipated growth of the market to 6 USD Billion by 2035 underscores the impact of these advancements.