Changing Consumer Lifestyles

Changing consumer lifestyles significantly influence the Portable Washing Machine Market. With an increasing number of individuals leading busy lives, the demand for convenient and time-saving appliances is on the rise. Portable washing machines cater to this need by offering quick and efficient laundry solutions that fit seamlessly into modern lifestyles. The market data suggests that the trend towards convenience is likely to continue, with a projected increase in sales as more consumers seek appliances that simplify their daily routines. Additionally, the rise of remote work and flexible living arrangements further fuels the demand for portable solutions. As lifestyles evolve, the Portable Washing Machine Market is poised to adapt, providing innovative products that align with the needs of contemporary consumers.

Growth of E-commerce Platforms

The growth of e-commerce platforms has a profound impact on the Portable Washing Machine Market. As online shopping becomes increasingly popular, consumers are more inclined to purchase appliances through digital channels. This shift not only expands the reach of manufacturers but also provides consumers with a wider variety of options and competitive pricing. Market data indicates that e-commerce sales in the appliance sector are expected to grow significantly, with online sales projected to account for a substantial portion of total sales in the coming years. This trend presents an opportunity for the Portable Washing Machine Market to leverage digital marketing strategies and enhance customer engagement. As e-commerce continues to flourish, the industry is likely to benefit from increased visibility and accessibility, driving further growth.

Increased Focus on Sustainability

The Portable Washing Machine Market is witnessing a heightened focus on sustainability, as consumers become more aware of their environmental impact. This trend is reflected in the growing demand for energy-efficient and water-saving washing machines. Manufacturers are responding by developing models that utilize less water and energy, aligning with global sustainability goals. Market data indicates that eco-friendly appliances are expected to capture a larger share of the market, with consumers willing to pay a premium for sustainable options. This shift not only benefits the environment but also enhances brand loyalty among consumers who prioritize eco-conscious products. As sustainability becomes a key purchasing criterion, the Portable Washing Machine Market is likely to thrive, driven by innovations that promote environmental responsibility.

Rising Demand for Compact Appliances

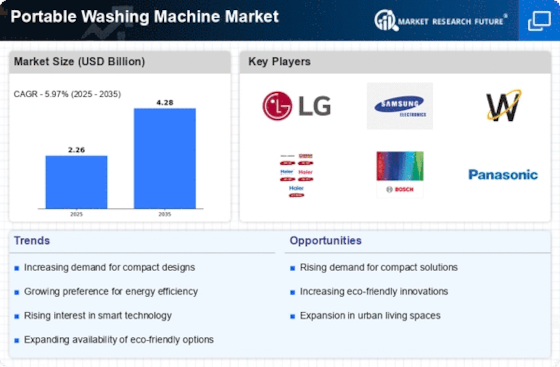

The Portable Washing Machine Market experiences a notable surge in demand for compact appliances, driven by urbanization and the increasing number of individuals living in smaller spaces. As more consumers seek efficient solutions for laundry, portable washing machines offer a practical alternative to traditional models. According to recent data, the market for portable washing machines is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is indicative of a broader trend where consumers prioritize convenience and space-saving designs. The Portable Washing Machine Market is thus positioned to benefit from this shift, as manufacturers innovate to meet the needs of urban dwellers who require effective yet compact laundry solutions.

Technological Advancements in Washing Machines

Technological advancements play a pivotal role in shaping the Portable Washing Machine Market. Innovations such as smart connectivity, energy-efficient designs, and enhanced washing capabilities are increasingly appealing to consumers. The integration of IoT technology allows users to control their washing machines remotely, providing added convenience. Furthermore, energy-efficient models are gaining traction, as consumers become more environmentally conscious. The market data suggests that the adoption of these advanced features could lead to a significant increase in sales, with projections indicating a potential market size of over 1 billion USD by 2028. As technology continues to evolve, the Portable Washing Machine Market is likely to see further growth driven by consumer demand for smarter, more efficient appliances.