Market Trends

Key Emerging Trends in the Porcine Vaccines Market

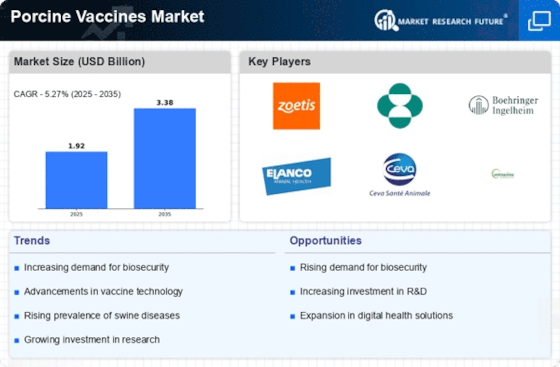

Porcine vaccinations are showing some intriguing tendencies. Pig farming modifications, disease prevention, and food safety values drive these developments. Veterinarians, pork producers, and vaccine manufacturers must grasp these market patterns to optimize pig health and productivity. The pig industry is booming because more people desire protein-rich diets. As bacon remains a valuable source of animal energy, pigs require excellent treatments to be healthy and prevent disease. New hog illnesses influence pig vaccination sales. African Swine Fever (ASF) and Porcine Epidemic Diarrhea Virus (PEDV) demonstrate the need for new vaccinations to address emerging pig farm issues. New technologies are altering pig vaccination production. New genetics and genomic technologies are improving medical efficacy and targeting. These modifications help prevent illnesses and make pigs healthier. Pig vaccinations are increasingly focused on protection. Stopping disease introduction and spread in pig communities is crucial to their health. Pig vaccinations are crucial to pork growers' security strategy. Knowing more about viral infections affects pig vaccine development. Animal-to-human illnesses like influenza are gaining attention. Pig vaccines protect communities and reduce zoonotic illness transmission. Globalization in pig farming affects pig medication sales. As pig farms grow increasingly interconnected, illnesses may spread across nations. This development requires drugs that can address particular pig farming issues. Combination vaccinations are increasing in pig health management. Combination vaccinations prevent many illnesses with one injection, making immunization regimens simpler and less traumatic for pigs. This tendency helps prevent disease transmission. Following laws and prioritizing vaccination safety are crucial in the pig vaccine business. To fulfill regulatory regulations, vaccine companies are investing in research and development to ensure their medicines are safe, effective, and approved. Pig farmers are prioritizing genetic preservation and disease tolerance. Selective breeding aims to generate disease-resistant pigs. Vaccinations and this strategy provide a more comprehensive disease-free pig farm plan. Digitalization is altering how vets deliver and monitor pig medications. Digital solutions simplify record-keeping, shot scheduling, and real-time pig health monitoring. This tendency makes massive pig farm immunization programs more effective and trackable. When public and private sectors produce vaccines together, new ideas emerge. Public-private partnership shares resources and expertise to accelerate pig medical research and development. Successful drugs are launched faster with this cooperative approach.

Leave a Comment