Polymer Bearing Size

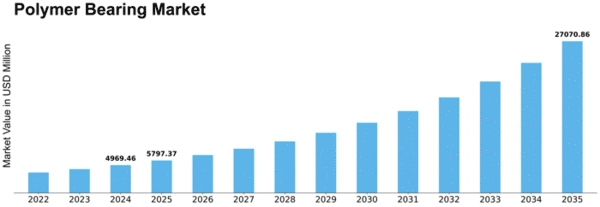

Polymer Bearing Market Growth Projections and Opportunities

The global polymer-bearing market is expected to expand at a CAGR of more than 4.78% during the forecast period to reach around USD 14.10 billion by 2025, according to MRFR analysis. Various factors influence and make up the Polymer Bearing Market. One major factor is the increasing demand for high-performance, maintenance-free bearing solutions across several industries like automotive, industrial, aerospace, and medical, among many others. Polymer bearings have advantages such as self-lubrication, corrosion resistance, and reduced friction, and they are made from materials like polytetrafluoroethylene (PTFE) nylon or acetal. In the automotive sector, polymer bearings are used in applications ranging from wheel hubs to suspension systems, thus enhancing efficiency and durability. This has been driven by the current trend towards light weighting in automotive design, which necessitates reliable yet low-friction components for use in its drive trains. Furthermore, polymer bearers' industrial sector contributes a lot to this industry, mainly in machinery and equipment, where they are an integral part of them as bearings. Polymer bearings can be found in conveyor systems pumps, compressors as well as other industrial machinery. The aerospace industry also plays a key role in influencing the Polymer bearing market. Polymer bearings are found to be used in aircraft landing gear control systems and aero engines. On this note, the aviation industry appreciates the lightweight nature of polymer bearings for fuel efficiency purposes. Also, polymer bearings are used for different purposes within medical equipment and devices. The biocompatibility, corrosion resistance, and design flexibility of polymer bearings Technological advancements in terms of new developments regarding polymer formulation and manufacturing processes contribute significantly to its growth. Researchers as well as manufacturers invest their time into developing high performance polymers having improved wear resistance capacities together with load bearing capabilities coupled with temperature stability. Moreover, the geographical locations where manufacturing activities take place and industrial infrastructure, including regulatory standards, greatly determine the nature of the Polymer bearing market. However, obstacles such as cost considerations, competition from traditional bearing materials, and application limitations could impact the Polymer bearing market in various ways. Nevertheless, the initial cost of polymer bearings may be higher compared to conventional metal bearings. Despite this, manufacturers and end-users will evaluate such lifecycle costs, taking into account maintenance issues, lubrication, and downtime before purchasing these polymer bearings.

Leave a Comment