Increasing Use in Surgical Sutures

The Polyglycolic Acid Market is experiencing a notable surge in demand for surgical sutures, primarily due to their biodegradable properties. These sutures are absorbed by the body over time, eliminating the need for removal and reducing the risk of infection. The market for surgical sutures is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is driven by the increasing number of surgical procedures and the rising preference for minimally invasive surgeries. As healthcare providers seek effective and safe solutions, the adoption of polyglycolic acid sutures is likely to expand, thereby enhancing the overall market landscape.

Growth in Agricultural Applications

The Polyglycolic Acid Market is witnessing growth in agricultural applications, particularly in the development of biodegradable mulch films and controlled-release fertilizers. These applications leverage the biodegradable nature of polyglycolic acid to promote sustainable agricultural practices. The agricultural film market is projected to grow at a rate of approximately 5% annually, driven by the need for environmentally friendly solutions. As farmers and agricultural companies increasingly adopt biodegradable materials to enhance crop yield while minimizing environmental impact, the demand for polyglycolic acid is likely to rise, further solidifying its role in the market.

Advancements in Drug Delivery Systems

The Polyglycolic Acid Market is witnessing advancements in drug delivery systems, which utilize polyglycolic acid as a key component. This polymer is particularly valued for its ability to encapsulate drugs and release them in a controlled manner. The market for drug delivery systems is expected to grow significantly, with estimates suggesting a growth rate of around 7% annually. This trend is largely attributed to the increasing focus on targeted therapies and personalized medicine. As pharmaceutical companies continue to innovate, the integration of polyglycolic acid in drug delivery systems is likely to enhance therapeutic efficacy, thereby driving demand within the market.

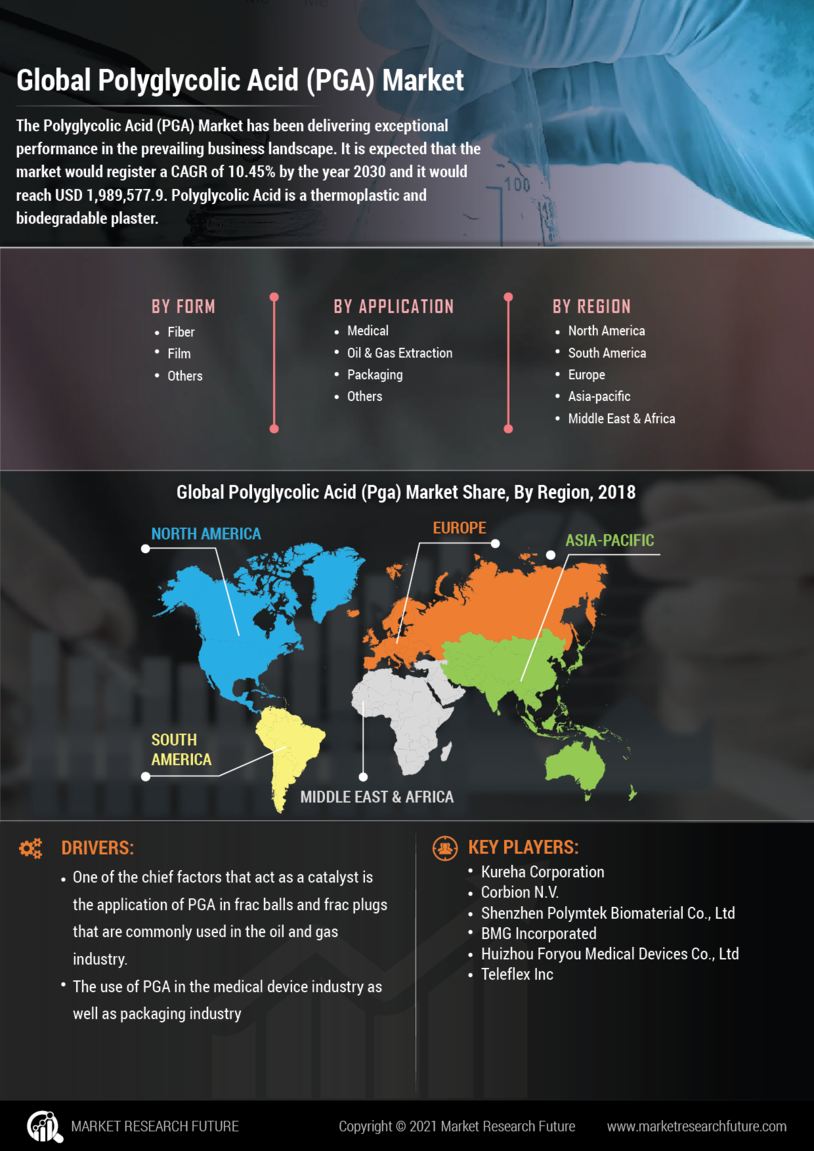

Rising Interest in Biodegradable Materials

The Polyglycolic Acid Market is benefiting from the rising interest in biodegradable materials across various sectors. As environmental concerns become more pronounced, industries are increasingly seeking sustainable alternatives to traditional plastics. Polyglycolic acid, being a biodegradable polymer, presents a viable solution for applications ranging from packaging to agricultural films. The market for biodegradable materials is projected to expand at a rate of approximately 8% per year, reflecting a shift towards eco-friendly practices. This growing awareness and demand for sustainable materials are likely to bolster the position of polyglycolic acid within the market.

Expansion in Tissue Engineering Applications

The Polyglycolic Acid Market is experiencing expansion in tissue engineering applications, where polyglycolic acid serves as a scaffold material. This polymer's biocompatibility and biodegradability make it an ideal candidate for supporting cell growth and tissue regeneration. The tissue engineering market is anticipated to grow at a compound annual growth rate of around 6% in the coming years. As research and development in regenerative medicine advance, the utilization of polyglycolic acid in tissue engineering is expected to increase, thereby enhancing its market presence and driving innovation.