Polyetherimide Size

Polyetherimide Market Growth Projections and Opportunities

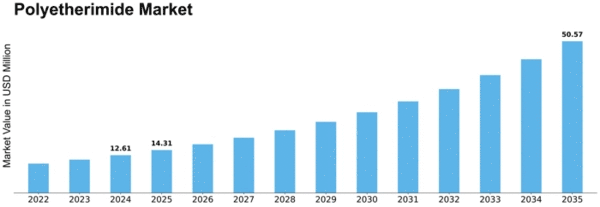

Polyetherimide (PEI) market dynamics are shaped by many market factors. Increasing demand for high-performance polymers across sectors is a factor. Automotive, aerospace, electronics, and healthcare have increased demand for polyetherimide because to its thermal and mechanical qualities. Manufacturing processes require lightweight, robust, and heat-resistant materials, driving this demand. Polyetherimide Market is expected to reach USD 870 Million by 2027, growing 7% annually.

Technological advances also affect Polyetherimide market dynamics. PEI's features and uses are improved by research and development, driving market expansion. Polymer chemistry and processing innovations allow producers to develop PEI with higher performance, broadening its uses and making it a favored choice in essential industries.

The Polyetherimide market is also affected by environmental and regulatory standards. Sustainable and eco-friendly materials are becoming more popular as governments globally tighten environmental rules. Recyclable and chemical-resistant polyetherimide meets these sustainability criteria, making it popular in sectors seeking green solutions.

Polyetherimide market circumstances depend on global economic conditions. Economic stability and growth affect industry-wide manufacturing and consumption. High-performance materials are in demand during economic boom, boosting the Polyetherimide industry. Economic downturns may delay production, hurting PEI demand.

Polyetherimide raw material availability and cost affect market dynamics and competition. PEI producers' production costs can be affected by bisphenol-A and other monomer price fluctuations. This impacts product pricing and market competition.

Geopolitics and trade policy influence the Polyetherimide market. Trade conflicts, tariffs, and geopolitical instability might affect PEI supply and pricing. Manufacturers must overcome these hurdles to maintain raw material supplies and minimize operational impacts.

Customer preferences and market trends affect Polyetherimide sales. End-users increasingly value materials that balance performance, cost, and sustainability. These choices drive the market to create new PEI formulations and applications that meet customer wants and industry trends.

Leave a Comment