Growth in the Construction Sector

The construction sector is witnessing robust growth, which is positively impacting the Polycarbonate Diol Market. Polycarbonate diols are increasingly used in construction materials, such as sealants and insulation products, due to their superior durability and thermal properties. The Polycarbonate Diol Market is projected to reach USD 10 trillion by 2027, with a significant portion of this growth attributed to the adoption of advanced materials like polycarbonate diols. As the demand for energy-efficient and sustainable building solutions rises, the role of polycarbonate diols in construction applications is likely to expand. This trend suggests a favorable outlook for the Polycarbonate Diol Market, as stakeholders capitalize on the growing opportunities within the construction sector.

Rising Demand for Eco-Friendly Products

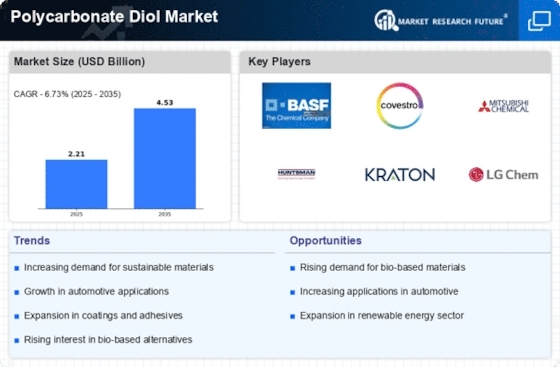

The increasing consumer preference for sustainable and eco-friendly products is driving the Polycarbonate Diol Market. As industries strive to reduce their carbon footprint, polycarbonate diols, known for their biodegradability and lower environmental impact, are gaining traction. This shift is particularly evident in sectors such as automotive and construction, where manufacturers are seeking alternatives to traditional materials. The market for polycarbonate diols is projected to grow at a compound annual growth rate of approximately 5% over the next few years, reflecting the rising demand for sustainable solutions. Companies are investing in research and development to enhance the properties of polycarbonate diols, making them more appealing for various applications. This trend indicates a significant opportunity for growth within the Polycarbonate Diol Market.

Increasing Use in the Automotive Industry

The automotive industry is increasingly adopting polycarbonate diols for various applications, thereby driving growth in the Polycarbonate Diol Market. These materials are favored for their lightweight properties, which contribute to improved fuel efficiency and reduced emissions in vehicles. As automotive manufacturers focus on sustainability and performance, the demand for polycarbonate diols is expected to rise. The market for lightweight automotive materials is projected to grow significantly, with polycarbonate diols playing a crucial role in this transformation. This trend indicates a promising future for the Polycarbonate Diol Market, as automotive companies seek innovative solutions to meet regulatory standards and consumer expectations.

Expansion in the Coatings and Adhesives Sector

The coatings and adhesives sector is experiencing substantial growth, which is positively impacting the Polycarbonate Diol Market. Polycarbonate diols are increasingly utilized in the formulation of high-performance coatings and adhesives due to their excellent mechanical properties and chemical resistance. The Polycarbonate Diol Market is expected to reach USD 200 billion by 2026, with a notable portion attributed to the use of polycarbonate diols. This expansion is driven by the construction and automotive industries, where durable and efficient coatings are essential. As manufacturers seek to enhance product performance, the demand for polycarbonate diols in this sector is likely to increase, presenting a lucrative opportunity for stakeholders in the Polycarbonate Diol Market.

Technological Innovations in Production Processes

Technological advancements in the production processes of polycarbonate diols are significantly influencing the Polycarbonate Diol Market. Innovations such as the development of more efficient catalytic processes and the use of renewable feedstocks are enhancing the production efficiency and sustainability of polycarbonate diols. These advancements not only reduce production costs but also improve the overall quality of the end products. As a result, manufacturers are better positioned to meet the growing demand for high-performance materials across various applications. The ongoing research in this area suggests that the Polycarbonate Diol Market will continue to evolve, with new technologies likely to emerge that further enhance the properties and applications of polycarbonate diols.