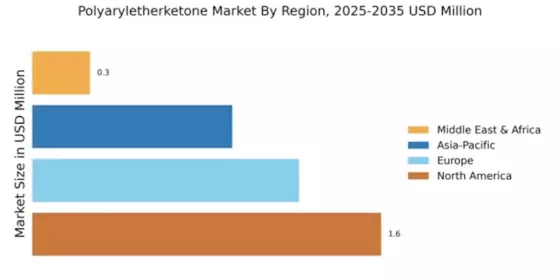

North America : Market Leader in PAEK

North America is poised to maintain its leadership in the Polyaryletherketone (PAEK) market, holding a significant market share of 1.57 in 2024. The region's growth is driven by increasing demand in aerospace, automotive, and medical sectors, alongside stringent regulations promoting high-performance materials. The push for lightweight and durable components is further catalyzing market expansion, supported by advancements in manufacturing technologies.

The United States stands as the primary contributor, with key players like Victrex, Solvay, and BASF leading the charge. The competitive landscape is characterized by innovation and strategic partnerships, enhancing product offerings. The presence of established companies and a robust supply chain infrastructure positions North America favorably for sustained growth in the PAEK market.

Europe : Innovation and Sustainability Focus

Europe's Polyaryletherketone market is projected to reach a size of 1.2 by 2025, driven by a strong emphasis on sustainability and innovation. Regulatory frameworks, such as the European Union's REACH, are pushing industries to adopt high-performance materials that meet environmental standards. The demand for PAEK in sectors like aerospace and automotive is on the rise, fueled by the need for lightweight and durable components that enhance efficiency and reduce emissions.

Germany and France are leading the charge in this market, with companies like Evonik Industries and BASF at the forefront. The competitive landscape is marked by a focus on R&D and collaboration among industry players to develop advanced materials. The European market is characterized by a blend of established firms and emerging innovators, ensuring a dynamic environment for PAEK growth.

Asia-Pacific : Emerging Market with Growth Potential

The Asia-Pacific region is witnessing a burgeoning Polyaryletherketone market, projected to reach 0.9 by 2025. The growth is primarily driven by increasing industrialization and the rising demand for high-performance materials in sectors such as electronics and automotive. Countries like Japan and China are at the forefront, with government initiatives supporting advanced manufacturing and innovation in material science, further propelling market growth.

Japan, with companies like Toray Industries and Mitsubishi Chemical, is a key player in the PAEK landscape. The competitive environment is evolving, with both local and international firms vying for market share. The region's focus on technological advancements and sustainable practices is expected to enhance the adoption of PAEK, making it a critical area for future investments.

Middle East and Africa : Developing Market with Opportunities

The Middle East and Africa region is gradually emerging in the Polyaryletherketone market, with a market size of 0.26 projected for 2025. The growth is driven by increasing industrial activities and a focus on diversifying economies away from oil dependency. The demand for high-performance materials in sectors like oil and gas, as well as aerospace, is beginning to gain traction, supported by government initiatives aimed at fostering innovation and technology adoption.

Countries such as South Africa and the UAE are leading the way, with a growing number of local and international players entering the market. The competitive landscape is still developing, but the presence of companies like SABIC indicates a commitment to expanding PAEK applications. As the region continues to invest in infrastructure and technology, the potential for PAEK growth remains significant.