Polished Concrete Size

Polished Concrete Market Growth Projections and Opportunities

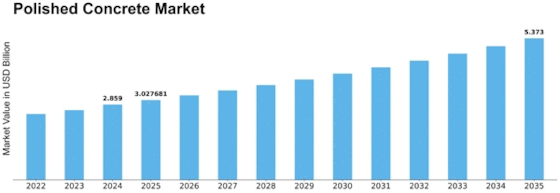

The polished concrete market is affected by a wide range of factors contributing to the dynamics and growth path of the industry. The demand for sustainable and eco-friendly construction solutions is also a major factor in the market. With environmental awareness on the rise, developers and homeowners alike are looking for solutions that would allow for the construction of facilities with lesser carbon emissions. Polished concrete, with its long life and energy efficiency properties features as a trend, increases its market. Polished Concrete Market Size was worth USD 2.5 billion in 2022. The Polished Concrete industry is expected to rise from USD 2.7 Billion in 2023 to USD 4.2 Billion in 2032 with a compound annual growth rate (CAGR) of 5.90%.

Besides that, economic factors are significant factors in the development of the polished concrete market. Usually, the period of prosperity is followed by increased construction activities, residential and commercial. In the phase of the economic expansion there is a spike of building projects that is caused by the higher need for polished concrete flooring. On the contrary, economic recessions may cause a decline in construction efforts, which will be negative for the market.

Technological advancements also massively affect the market dynamics. The innovations in the concrete polishing techniques and equipment improve the output and quality of the final product. Other than drawing new clients, it also makes current ones prefer treated concrete. The construction industry has seen development of new materials and methods. This obviously affects the choices architects, builders and home owners make, in turn affecting the demand for polished concrete.

The trends in architecture and design in construction sector also define the consumer market for polished concrete. With the rise of modern designs and industrial aesthetics, demand for polished concrete surfaces as a design element grows. The flexibility of polished concrete allows it to coexist with different designs, hence it is increasingly becoming a preferred choice for architects and designers who want to achieve a modern and clutter-free look.

Regulatory agencies also play vital roles in the polished concrete market. The governments' regulations and policies on sustainable construction practices, emissions, air quality inside can potentially be the factors that determine the choice of flooring material. Polished concrete with low Volatile Organic Compound (VOC) emissions, being an eco-friendly choice, supports this legislation which further incentivize use of polished concrete in construction projects.

Market competition and the existence of substitute flooring solutions also affect the polished concrete market. Cheap and desirable options/materials may compete with polished concrete for the attention of the customers.

Leave a Comment