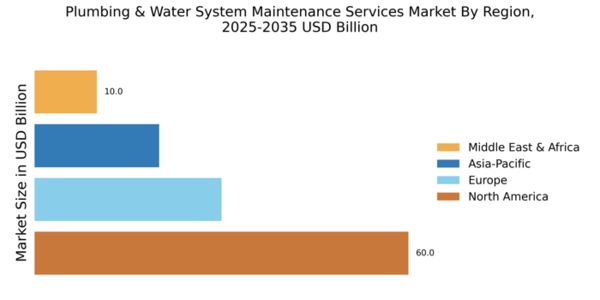

North America : Market Leader in Services

North America holds a commanding 60.0% share of the Plumbing & Water System Maintenance Services Market, driven by a robust demand for residential and commercial plumbing solutions. Factors such as aging infrastructure, increased urbanization, and stringent regulations on water quality are propelling market growth. The region's focus on sustainable practices and advanced technologies further enhances service efficiency and customer satisfaction.

The competitive landscape is characterized by key players like Roto-Rooter, Mr. Rooter, and Benjamin Franklin Plumbing, which dominate the market with extensive service networks. The U.S. remains the leading country, supported by a high demand for emergency plumbing services and preventive maintenance. The presence of established brands ensures a competitive edge, while ongoing investments in technology and customer service are expected to drive future growth.

Europe : Emerging Market Dynamics

Europe accounts for a significant 30.0% of the Plumbing & Water System Maintenance Services Market, with growth driven by increasing investments in infrastructure and a rising focus on environmental sustainability. Regulatory frameworks promoting water conservation and quality standards are key catalysts for market expansion. The demand for innovative plumbing solutions is also on the rise, as consumers seek energy-efficient and eco-friendly options.

Leading countries in this region include Germany, the UK, and France, where established companies like HomeServe and local players are enhancing service offerings. The competitive landscape is evolving, with a mix of traditional and new entrants focusing on technology integration. The market is expected to grow as companies adapt to changing consumer preferences and regulatory requirements, ensuring a robust service environment.

Asia-Pacific : Rapid Growth Potential

Asia-Pacific represents a growing segment of the Plumbing & Water System Maintenance Services Market, holding a 25.0% share. The region's rapid urbanization, population growth, and increasing disposable incomes are driving demand for plumbing services. Additionally, government initiatives aimed at improving sanitation and water management are significant growth drivers. The focus on modernizing infrastructure is expected to further boost market dynamics in the coming years.

Countries like China, India, and Japan are at the forefront of this growth, with a mix of local and international players competing for market share. The competitive landscape is characterized by both established companies and new entrants, focusing on innovative solutions and customer service. As the region continues to develop, the demand for efficient plumbing services is anticipated to rise, creating opportunities for market expansion.

Middle East and Africa : Emerging Market Opportunities

The Middle East & Africa region, with a market share of 5.0%, is gradually emerging in the Plumbing & Water System Maintenance Services Market. The growth is primarily driven by increasing urbanization, infrastructure development, and a rising awareness of water conservation. Government initiatives aimed at improving water supply and sanitation are also contributing to market expansion. The region's unique challenges, such as water scarcity, are prompting innovative plumbing solutions.

Leading countries include South Africa and the UAE, where local and international companies are establishing a presence. The competitive landscape is evolving, with a focus on sustainable practices and technology adoption. As the region continues to develop, the demand for plumbing services is expected to grow, presenting opportunities for both established players and new entrants to capture market share.