Rising Urbanization

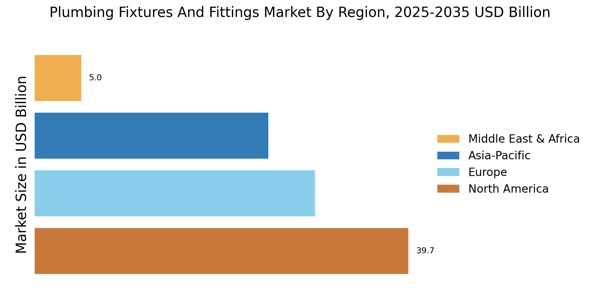

Urbanization is a critical driver for the Plumbing Fixtures And Fittings Market, as more individuals migrate to urban areas seeking better living conditions. This demographic shift leads to increased demand for residential and commercial plumbing installations. As urban populations grow, the need for modern plumbing infrastructure becomes essential. Recent statistics suggest that urban areas are expected to account for over 70% of the global population by 2050, thereby driving the demand for plumbing fixtures and fittings. This trend presents substantial opportunities for manufacturers and suppliers within the industry.

Regulatory Compliance

Regulatory compliance is a significant driver in the Plumbing Fixtures And Fittings Market, as governments worldwide implement stricter standards for water efficiency and safety. These regulations compel manufacturers to innovate and produce fixtures that meet or exceed these requirements. Compliance with standards such as the WaterSense program in the United States encourages the development of high-efficiency products. As a result, companies that prioritize regulatory adherence are likely to gain a competitive edge in the market. The ongoing evolution of regulations will continue to shape product offerings and market strategies.

Sustainability Trends

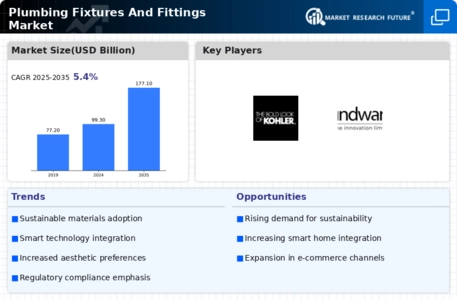

Sustainability is increasingly influencing consumer choices within the Plumbing Fixtures And Fittings Market. There is a growing preference for eco-friendly products that utilize sustainable materials and promote water efficiency. Manufacturers are responding to this demand by developing fixtures that minimize water usage without compromising performance. Data indicates that the market for sustainable plumbing products is expected to grow at a compound annual growth rate of 15% over the next five years. This shift towards sustainability not only aligns with environmental goals but also enhances brand reputation and consumer loyalty.

Technological Advancements

The Plumbing Fixtures And Fittings Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as smart faucets, touchless fixtures, and integrated water-saving technologies are becoming increasingly prevalent. These advancements not only enhance user convenience but also promote water conservation, which is a growing concern among consumers. According to recent data, the adoption of smart plumbing solutions is projected to increase by approximately 25% over the next five years. This trend indicates a shift towards more efficient and user-friendly plumbing systems, which could significantly impact the overall market dynamics.

Consumer Awareness and Preferences

Consumer awareness regarding plumbing efficiency and design is a pivotal driver in the Plumbing Fixtures And Fittings Market. As consumers become more informed about the benefits of modern plumbing solutions, their preferences shift towards high-quality, aesthetically pleasing fixtures. This trend is reflected in the increasing demand for customizable and stylish plumbing products that enhance the overall appeal of residential and commercial spaces. Market Research Future indicates that nearly 60% of consumers prioritize design and functionality when selecting plumbing fixtures, suggesting that manufacturers must adapt to these evolving preferences to remain competitive.