Technological Innovations

Technological advancements play a crucial role in shaping the Platinum and Palladium Carbon Catalyst Market. Innovations in catalyst design and manufacturing processes have led to enhanced performance and durability of these catalysts. For instance, the development of nanostructured catalysts has shown promise in improving catalytic efficiency and reducing the amount of precious metals required. This is particularly relevant as the prices of platinum and palladium remain volatile. In 2025, the market is expected to benefit from these innovations, with a projected increase in the adoption of advanced catalytic systems across various sectors, including automotive and chemical manufacturing. The integration of artificial intelligence in catalyst optimization further indicates a transformative shift in how these materials are utilized.

Sustainability Initiatives

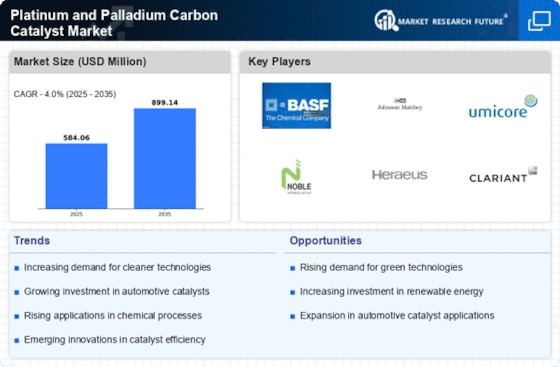

The increasing emphasis on sustainability is a pivotal driver for the Platinum and Palladium Carbon Catalyst Market. Industries are progressively adopting eco-friendly practices, leading to a surge in demand for catalysts that facilitate cleaner chemical processes. Platinum and palladium catalysts are recognized for their efficiency in reducing harmful emissions, particularly in automotive applications. As regulatory frameworks tighten around emissions standards, the need for effective catalytic converters becomes paramount. In 2025, the market for platinum and palladium catalysts is projected to witness a growth rate of approximately 6% annually, driven by these sustainability initiatives. This trend not only aligns with corporate social responsibility goals but also enhances the competitive edge of companies that prioritize environmentally friendly technologies.

Rising Demand in Automotive Sector

The automotive sector is a significant driver for the Platinum and Palladium Carbon Catalyst Market. As the automotive industry transitions towards more stringent emission regulations, the demand for efficient catalytic converters is escalating. Platinum and palladium catalysts are essential in the reduction of nitrogen oxides and particulate matter from exhaust gases. In 2025, it is anticipated that the automotive sector will account for over 60% of the total demand for these catalysts. This trend is further fueled by the growing popularity of hybrid and electric vehicles, which still require effective catalytic solutions to meet regulatory standards. Consequently, the automotive industry's evolution is likely to sustain the growth trajectory of the platinum and palladium catalyst market.

Investment in Research and Development

Investment in research and development is a critical driver for the Platinum and Palladium Carbon Catalyst Market. As companies strive to enhance catalyst performance and reduce costs, R&D initiatives are becoming increasingly vital. This focus on innovation is expected to yield breakthroughs in catalyst formulations and recycling technologies, which could significantly impact market dynamics. In 2025, it is projected that R&D expenditures in the catalyst sector will increase by approximately 10%, reflecting the industry's commitment to advancing catalytic technologies. Such investments not only aim to improve the efficiency of platinum and palladium catalysts but also address the challenges associated with resource scarcity and environmental impact, thereby ensuring the long-term sustainability of the market.

Emerging Applications in Chemical Industry

Emerging applications within the chemical industry are significantly influencing the Platinum and Palladium Carbon Catalyst Market. The versatility of platinum and palladium catalysts extends beyond traditional uses, finding new roles in fine chemical synthesis and pharmaceutical manufacturing. As industries seek to optimize production processes and enhance product quality, the demand for high-performance catalysts is likely to rise. In 2025, the chemical sector is projected to contribute a notable share to the overall market, driven by the need for catalysts that can operate under mild conditions while maintaining high selectivity. This shift towards innovative applications underscores the adaptability of platinum and palladium catalysts in meeting diverse industrial needs.