Growing Awareness of Thrombotic Disorders

The rising awareness of thrombotic disorders among healthcare professionals and patients is a significant driver for the Platelet Aggregation Devices Market. Educational initiatives and campaigns aimed at highlighting the risks associated with thrombosis are leading to increased screening and testing. As more individuals become informed about the implications of platelet function in cardiovascular health, the demand for reliable diagnostic tools rises. This heightened awareness is prompting healthcare providers to utilize platelet aggregation devices more frequently in clinical settings. Consequently, the market is likely to experience growth as the understanding of thrombotic disorders continues to expand, driving the need for effective monitoring solutions.

Increasing Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is shaping the Platelet Aggregation Devices Market. As healthcare systems worldwide shift towards proactive management of health conditions, the demand for diagnostic tools that can identify potential risks is on the rise. Platelet aggregation devices are integral in this paradigm, as they enable early detection of platelet dysfunction, which is a precursor to various cardiovascular events. This trend is supported by initiatives aimed at promoting regular health screenings and risk assessments. Consequently, healthcare providers are increasingly incorporating these devices into routine check-ups, further expanding their market reach and utilization.

Technological Innovations in Device Design

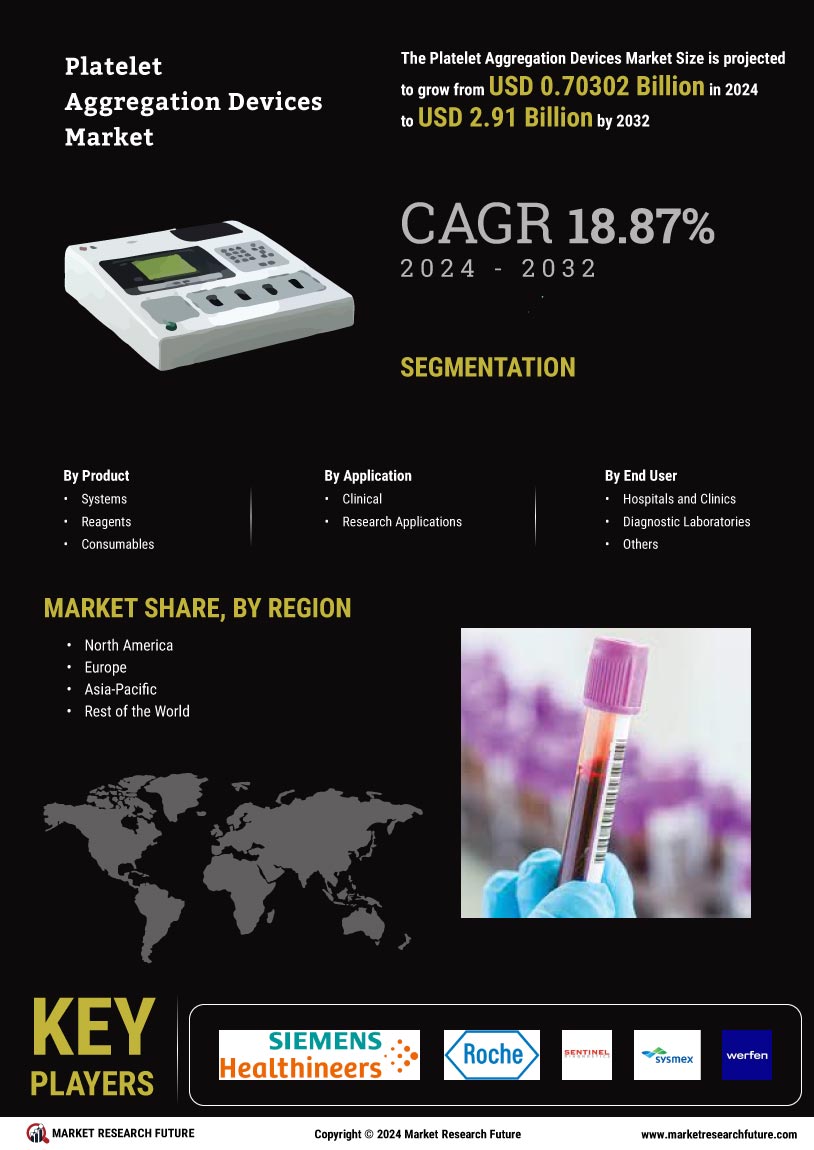

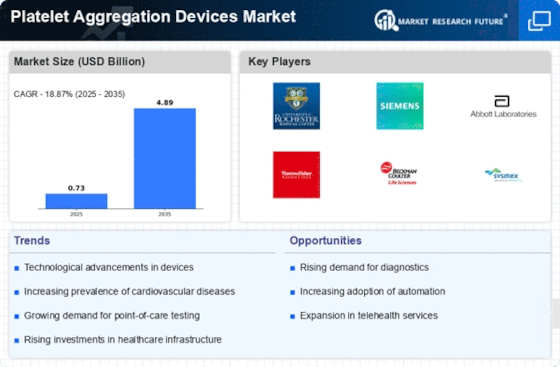

Technological advancements in the design and functionality of platelet aggregation devices are significantly influencing the Platelet Aggregation Devices Market. Innovations such as miniaturization, enhanced sensitivity, and user-friendly interfaces are making these devices more accessible and efficient. For instance, the introduction of portable and point-of-care devices allows for rapid testing in various clinical settings, which is particularly beneficial in emergency situations. The market is witnessing a surge in research and development activities aimed at improving the accuracy and reliability of these devices. As a result, healthcare professionals are more inclined to adopt these advanced technologies, thereby driving market growth.

Rising Incidence of Cardiovascular Diseases

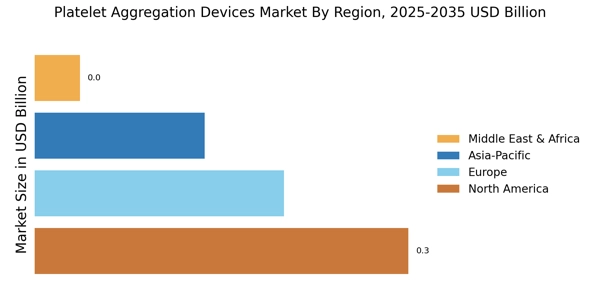

The increasing prevalence of cardiovascular diseases is a primary driver for the Platelet Aggregation Devices Market. As heart-related ailments continue to rise, the demand for effective diagnostic and monitoring tools becomes more pronounced. According to recent statistics, cardiovascular diseases account for a significant percentage of global mortality rates, necessitating advanced medical interventions. This trend is likely to propel the adoption of platelet aggregation devices, which play a crucial role in assessing platelet function and guiding treatment decisions. Furthermore, healthcare providers are increasingly recognizing the importance of these devices in managing patients with a high risk of thrombotic events, thereby enhancing their market presence.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are pivotal in driving the Platelet Aggregation Devices Market. Governments and health authorities are recognizing the importance of these devices in improving patient outcomes and are thus facilitating their approval processes. Additionally, many insurance providers are beginning to cover the costs associated with platelet aggregation testing, making these devices more accessible to a broader patient population. This financial backing encourages healthcare facilities to invest in advanced diagnostic tools, thereby fostering market growth. As reimbursement policies continue to evolve, the adoption of platelet aggregation devices is expected to increase, further solidifying their role in clinical practice.