Market Trends

Key Emerging Trends in the Plastic Antioxidants Market

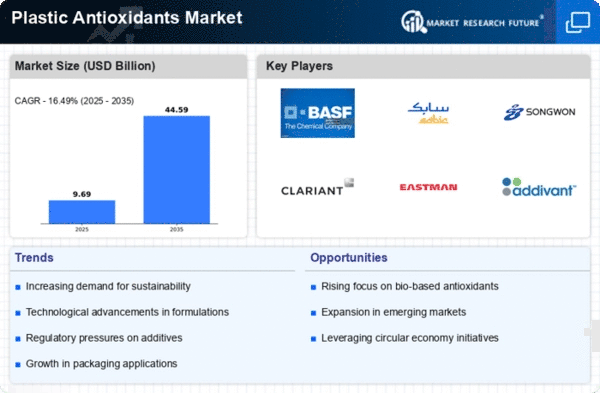

In recent days, significant trends have been experienced that have completely transformed the plastics antioxidant industry. One is the high need for these additives which can enhance the durability of a plastic material over time. The demand for effective antioxidants has risen given that a majority of sectors across continents use plastics in packaging, construction and others.

Environmental consciousness has had a strong influence on market trends. Manufacturing sector has come under pressure from stakeholders demanding longer lived plastic products due growing environmental concerns about plastic waste. They prevent degradation of polymer chains upon exposure to elements like UV rays, heat or oxygen among other things. Consequently, there is an increasing preference for anti-oxidizing agents in formulating more sustainable plastics that resist changes emerging from different industries.

Bio-based antioxidants are becoming increasingly popular within this industry as well. The need to consider sustainability aspect has led to an increase in demand for eco-friendly options among both businesses and customers. Bio based antioxidants derived from plant source renewable materials tend to be more environmentally friendly than conventional synthetic ones so they make good replacements instead.Therefore, this shift signifies a broader move towards greener chemical additives production with lower reliance on fossil fuels.

Market dynamics have also changed due to new regulations aimed at some chemicals being further studied in detail. Certain governments together with international organizations are implementing stricter rules regarding the use of additives across various areas including plastics.The regulations forced manufacturers into reconsidering their formulations and looking out for substitutes that meet changing standards.As a result strict regulatory demands were met while still maintaining performance and effectiveness of the antioxidants in the plastic antioxidants market leading to formulation development.

Globalization is another factor influencing market trends. The fast growth of international markets has increased the competition between producers, which drives them to innovate and differentiate their products. This has resulted in the development of new generation antioxidant formulations having improved properties. Manufacturers are heavily investing billions in research and development (R&D) hence creating volatile conditions in plastic antioxidants market so as to outshine each other.

Furthermore, plastic antioxidants market is propelled forward by packaging sector. Over time, the packaging sector has grown exceptionally due to rising demand for packaged products on one hand and e-commerce business on the other hand. These additives are crucial because they increase life span of goods and maintain their quality throughout storage or transportation process. That’s why packagers increasingly require these anti-oxidizing agents from companies that package their produce for dealing with today’s supply chain stringent requirements.

Leave a Comment