Regulatory Support for Safe Ingredients

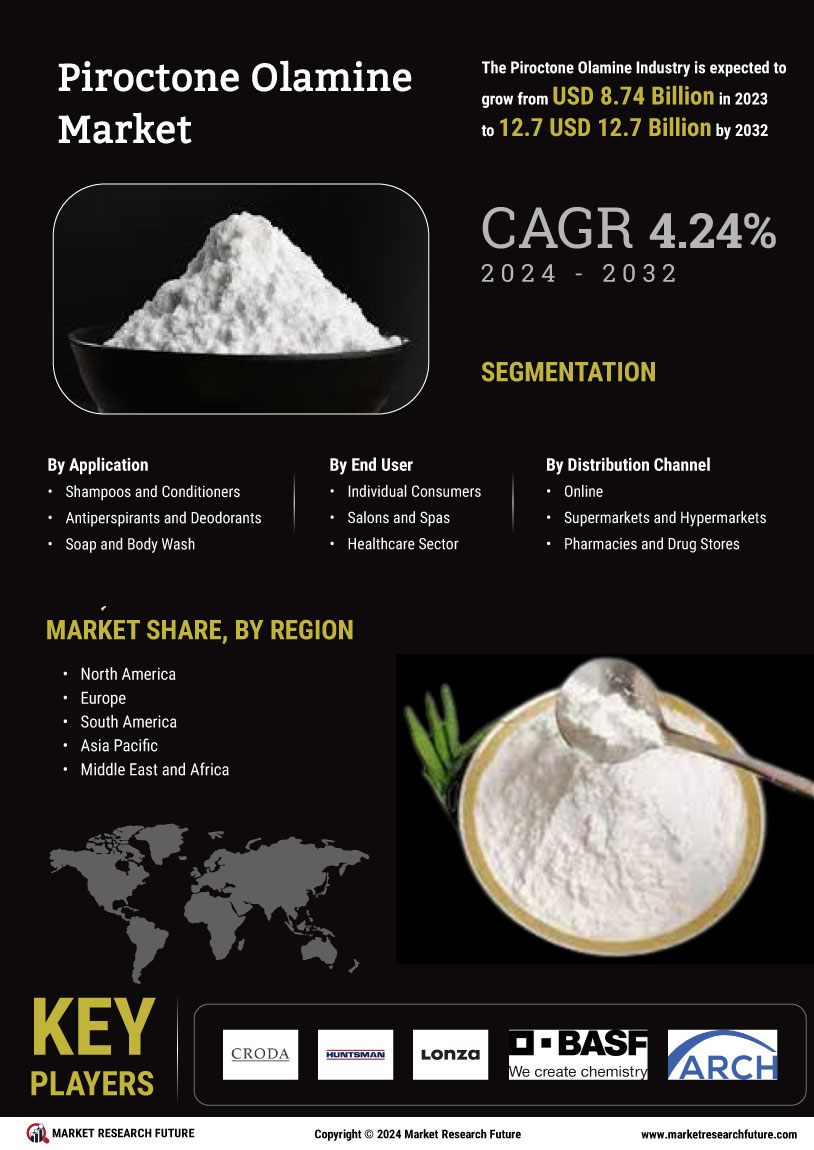

Regulatory support for safe and effective ingredients is a driving force in the Piroctone Olamine Market. As consumers become more conscious of product safety, regulatory bodies are emphasizing the importance of using safe and clinically tested ingredients in personal care products. Piroctone Olamine Market, recognized for its safety profile and efficacy, aligns well with these regulatory trends. This support not only enhances consumer trust but also encourages manufacturers to incorporate Piroctone Olamine Market in their formulations. Industry expert's indicate that products adhering to stringent safety regulations are likely to experience higher demand, suggesting a positive outlook for the Piroctone Olamine Market.

Increasing Awareness of Dandruff Solutions

The rising awareness regarding scalp health and the prevalence of dandruff has propelled the Piroctone Olamine Market. Consumers are increasingly seeking effective solutions to combat dandruff, which affects a significant portion of the population. This awareness is further fueled by educational campaigns and marketing efforts from manufacturers. As a result, the demand for products containing Piroctone Olamine Market, known for its antifungal properties, is on the rise. Market data indicates that the anti-dandruff segment is expected to witness substantial growth, with a projected CAGR of over 5% in the coming years. This trend suggests that the Piroctone Olamine Market is well-positioned to capitalize on the growing consumer focus on scalp health.

Growing E-commerce and Online Retail Channels

The proliferation of e-commerce and online retail channels is reshaping the Piroctone Olamine Market. With the convenience of online shopping, consumers are more inclined to purchase hair care products, including those containing Piroctone Olamine Market, from digital platforms. This shift is supported by the increasing penetration of smartphones and internet access, allowing consumers to explore a wider range of products. Market data reveals that online sales of personal care products are expected to grow by 20% over the next few years. This trend suggests that the Piroctone Olamine Market could benefit from enhanced visibility and accessibility through online retail, potentially driving sales and market expansion.

Expansion of Personal Care and Cosmetic Sectors

The expansion of the personal care and cosmetic sectors has a notable impact on the Piroctone Olamine Market. As consumers increasingly prioritize personal grooming and hygiene, the demand for hair care products, particularly those addressing scalp issues, has surged. The market for hair care products is projected to reach USD 100 billion by 2026, with a significant portion attributed to anti-dandruff formulations. Piroctone Olamine Market, recognized for its efficacy in treating dandruff and promoting scalp health, is becoming a key ingredient in various formulations. This growth in the personal care sector indicates a favorable environment for the Piroctone Olamine Market, as manufacturers innovate to meet consumer demands.

Rising Preference for Multi-Functional Products

The trend towards multi-functional personal care products is influencing the Piroctone Olamine Market. Consumers are increasingly inclined towards products that offer multiple benefits, such as dandruff control, moisturizing, and hair strengthening. This shift is prompting manufacturers to formulate innovative products that incorporate Piroctone Olamine Market alongside other beneficial ingredients. Market analysis suggests that products combining anti-dandruff properties with nourishing elements are gaining traction, potentially leading to a market growth rate of 6% annually. This trend indicates that the Piroctone Olamine Market may experience increased demand as consumers seek comprehensive solutions for their hair care needs.