Research Methodology on Pipe Coatings Market

1. Introduction

The research methodology adopted in this study seeks to explore the market potential of pipe coatings in the global market. To understand the market potential of this sector, it is important to understand what the industry entails. In this regard, the research process followed some rigorous steps.

2. Research Objectives

The main objective of this study is to gain an in-depth knowledge of the global pipe coatings market and identify the factors driving its growth. The research aims to take an in-depth understanding of the market dynamics and trends, assess the competitive landscape of the market, and gain a deep understanding of the competitive dynamics in the market.

3. Literature Review

The literature review for this research was conducted with the help of various sources such as industry journals, research reports, white papers, and market reports. The publications were reviewed in order to gain insights into the market trends, structure and dynamics, key players, and the competitive landscape.

4. Data Collection

Data for this study has been collected from both primary and secondary sources. Primary data sources included market surveys, interviews with industry professionals, and data gathered from a team of market research experts. In addition, secondary data in the form of industry reports, statistical databases and reports, and government websites were also used to gain an in-depth understanding of the market.

5. Analysis Techniques

Both quantitative and qualitative analysis techniques have been used in this study. Quantitative analysis was used to assess the market size and to identify the market potential. The quantitative analysis was conducted through regression and correlation analysis, while the qualitative analysis was used to collect and analyze market trends, drivers and restraints, and analyse the competitive dynamics in the market.

6. Findings

Based on the data collected, the following findings were noted:

--The increasing demand for energy-efficient pipe coatings, due to stringent government regulations and awareness among consumers, is driving the growth of the global pipe coatings market.

--The factors restraining the growth of the market are the high cost of raw materials, the availability of substitutes, and the increasing complexity of coating processes.

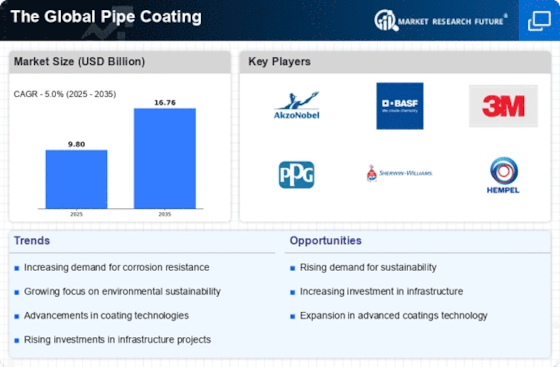

--The key players in the market are Flowchem LLC, Specialty Coating Systems, Inc., AkzoNobel, PPG Industries, and Tnemec Company Inc., amongst others.

7. Conclusion

The market research study on the global pipe coatings market has been conducted to gain a comprehensive understanding of the market dynamics, trends and potential. The findings from the research revealed that the market is driven by increasing demand for energy-efficient pipe coatings, due to stringent government regulations and awareness among consumers; and is restrained by the high cost of raw materials, availability of substitutes, and the increasing complexity of coating processes. The key players in the market are Flowchem LLC, Specialty Coating Systems, Inc., AkzoNobel, PPG Industries, and Tnemec Company Inc., amongst others.