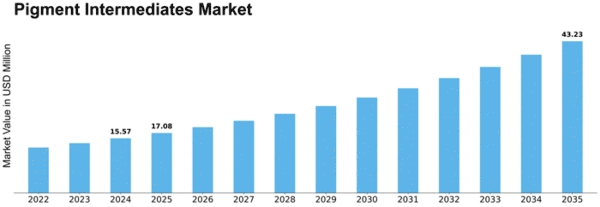

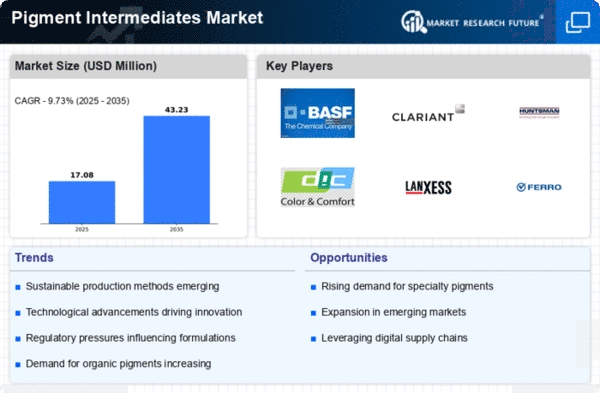

Pigment Intermediates Size

Pigment Intermediates Market Growth Projections and Opportunities

The Pigment Intermediates Market is influenced by a myriad of market factors, which collectively shape its dynamics and growth trajectory. Among them is the global demand for pigments across different sectors such as paints and coatings, plastics, textiles and printing inks. Construction boom alongside increased expenditures on home renovations hugely drives the need for pigments thus affecting pigment intermediates market.

In addition, progressions in automotive industry are overriding influences that determine how pigment intermediates markets develop. In the manufacture of external as well as internal car components; auto industry uses pigments. With growing car making sector and innovative smarts’ there comes an increase in demand for high quality specialized pigments hence impacting the pigment intermediates market.

Raw material availability and pricing are critical market factors that directly impact the pigment intermediates industry. Geopolitical events or natural calamities among others can affect the cost and availability of these chemicals compounds which form the bulk of raw materials for pigment intermediates. Disruption in the chain supplying raw materials could therefore lead to negative effects on production and pricing of pigment intermediates.

Similarly, environmental regulations including concerns related to sustainability significantly contribute to shaping up pigment intermediates market. There is increasing environmental awareness leading to more eco friendly sustainable forms of colorant demands across all industries based on their various applications. Hence, manufacturers have been necessitated into research & development investment aimed at producing environmentally regulatory compliant intermediate pigments which has brought about extensive use within an industry towards more sustainable practices.

Market competition also plays a major role in explaining changes in the world’s paint sector however little attention is paid to it. High levels of rivalry between other players results into constant innovation taking place within this business area while competitive prices are offered together with new or improved formulations for colorants. Some firms attempt to distinguish themselves through unique offerings or by focusing on specific segments; Consequently, the competition in the pigments intermediates market has increased.

Global economic conditions and trade policies also contribute to the market dynamics of pigment intermediates. Global demand for these colorants is dictated by world economy or international politics that may influence industrial output as well as consumer spending directly deciding the consumption of pigments thus leading to changes in pigment intermediates market. Additionally, trade policies and tariffs affect raw material cost as well as finished product pricing thereby complicating further these global markets.

Leave a Comment