Increased Investment in R&D

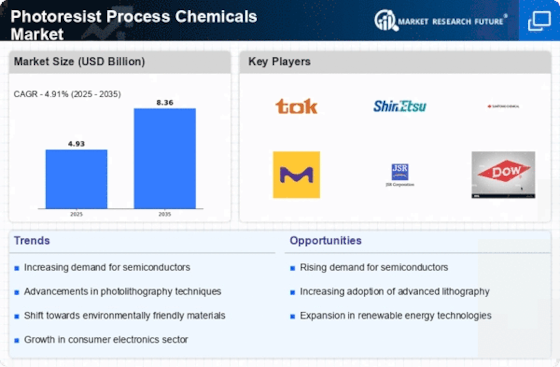

Investment in research and development (R&D) within the semiconductor sector is a significant driver for the Photoresist Process Chemicals Market. Companies are allocating substantial resources to develop new materials and processes that enhance the efficiency and effectiveness of semiconductor manufacturing. This focus on R&D is expected to lead to the introduction of novel photoresist formulations that can meet the stringent requirements of next-generation devices. As a result, the market is likely to witness a compound annual growth rate (CAGR) of around 5% over the next few years, reflecting the industry's commitment to innovation and technological advancement.

Growing Focus on Miniaturization

The trend towards miniaturization in electronic devices is a key driver for the Photoresist Process Chemicals Market. As consumer preferences shift towards compact and lightweight gadgets, manufacturers are compelled to produce smaller and more efficient components. This miniaturization trend is particularly evident in smartphones, wearables, and IoT devices, which require advanced photoresist materials to achieve the desired precision and performance. The market for photoresist chemicals is anticipated to grow in tandem with this trend, as companies invest in research and development to create innovative solutions that cater to the demands of miniaturized electronics.

Rising Demand for Semiconductors

The Photoresist Process Chemicals Market is experiencing a notable surge in demand driven by the increasing need for semiconductors across various sectors. As industries such as automotive, consumer electronics, and telecommunications expand, the requirement for advanced semiconductor devices intensifies. According to recent data, the semiconductor market is projected to reach a valuation of over 500 billion dollars by 2026, which inherently boosts the demand for photoresist chemicals essential in the manufacturing processes. This trend indicates a robust growth trajectory for the Photoresist Process Chemicals Market, as manufacturers seek to enhance production efficiency and meet the evolving technological requirements.

Advancements in Photolithography Techniques

Innovations in photolithography techniques are significantly influencing the Photoresist Process Chemicals Market. The introduction of extreme ultraviolet (EUV) lithography and nanoimprint lithography has revolutionized the manufacturing of integrated circuits, allowing for smaller feature sizes and improved performance. These advancements necessitate the development of specialized photoresist materials that can withstand the complexities of new lithography methods. As a result, the market for photoresist chemicals is expected to expand, with a projected growth rate of approximately 6% annually over the next five years. This growth reflects the industry's adaptation to cutting-edge technologies and the increasing sophistication of semiconductor manufacturing.

Regulatory Compliance and Environmental Standards

The Photoresist Process Chemicals Market is increasingly influenced by regulatory compliance and environmental standards. As governments and organizations worldwide implement stricter regulations regarding chemical usage and waste management, manufacturers are compelled to adopt more sustainable practices. This shift towards eco-friendly photoresist materials not only aligns with regulatory requirements but also meets the growing consumer demand for environmentally responsible products. Consequently, the market is expected to evolve, with a projected increase in the adoption of green chemistry principles, potentially leading to a market growth rate of 4% annually as companies strive to balance performance with sustainability.