Increased Focus on Sustainability

The Photolithography Market is increasingly aligning with sustainability initiatives, as manufacturers seek to reduce their environmental impact. This focus is evident in the development of eco-friendly photolithography materials and processes that minimize waste and energy consumption. As of 2025, the market for sustainable photolithography solutions is projected to grow, driven by regulatory pressures and consumer demand for greener technologies. Companies are investing in research to develop alternative materials that are less harmful to the environment while maintaining performance standards. This trend not only enhances the reputation of manufacturers but also positions them favorably in a market that is progressively prioritizing sustainability. The integration of sustainable practices within the Photolithography Market may lead to innovative solutions that address both environmental concerns and operational efficiency.

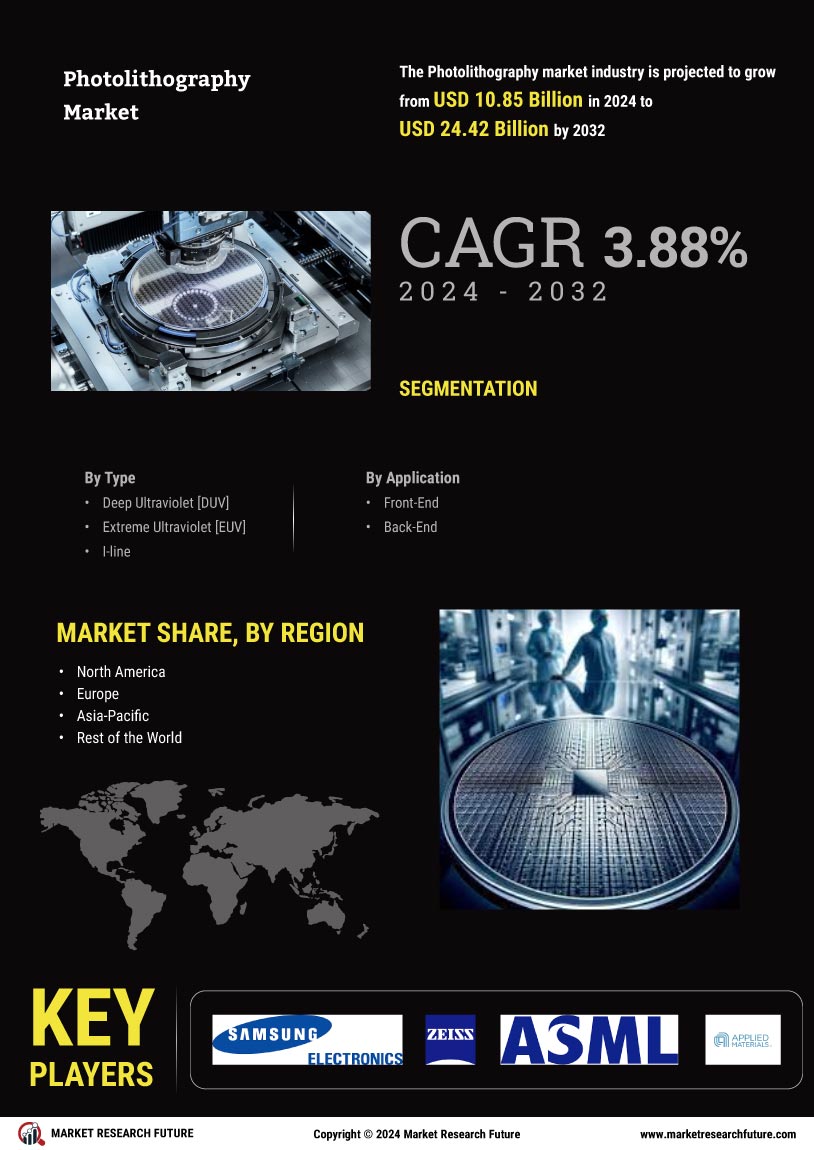

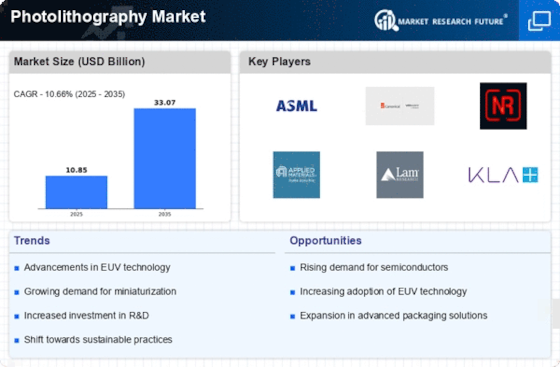

Rising Demand for Semiconductor Devices

The Photolithography Market is significantly influenced by the rising demand for semiconductor devices across various sectors, including consumer electronics, automotive, and telecommunications. As of 2025, the semiconductor market is anticipated to exceed 600 billion USD, with photolithography playing a crucial role in the manufacturing process. The proliferation of smart devices and the increasing integration of advanced technologies, such as IoT and AI, are propelling this demand. Consequently, semiconductor manufacturers are ramping up production capacities, which in turn drives the need for advanced photolithography solutions. This trend suggests that the Photolithography Market will continue to expand, as companies seek to enhance their production capabilities to meet the growing consumer and industrial needs.

Technological Advancements in Equipment

The Photolithography Market is currently experiencing a surge in technological advancements, particularly in photolithography equipment. Innovations such as extreme ultraviolet (EUV) lithography are enabling the production of smaller and more complex semiconductor devices. As of 2025, the market for EUV lithography systems is projected to reach approximately 10 billion USD, reflecting a robust growth trajectory. These advancements not only enhance the precision of patterning but also improve throughput and reduce costs. Consequently, manufacturers are increasingly investing in state-of-the-art photolithography tools to maintain competitive advantages. This trend is likely to continue, as the demand for high-performance chips in applications such as artificial intelligence and 5G technology escalates, thereby driving the Photolithography Market forward.

Emerging Applications in Advanced Technologies

The Photolithography Market is witnessing a diversification of applications, particularly in advanced technologies such as quantum computing and nanotechnology. These emerging fields require highly specialized photolithography techniques to fabricate intricate structures at the nanoscale. As of 2025, investments in research and development for these applications are expected to increase, potentially reaching several billion USD. This shift indicates a growing recognition of the importance of photolithography in enabling breakthroughs in technology. Companies are likely to explore innovative photolithography methods to cater to these niche markets, thereby expanding the overall scope of the Photolithography Market. The interplay between traditional semiconductor manufacturing and these advanced applications could lead to new opportunities and challenges in the industry.

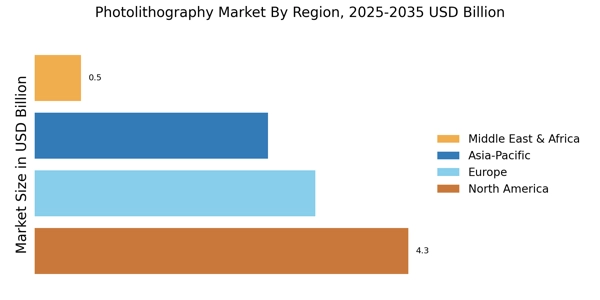

Global Expansion of Semiconductor Manufacturing

The Photolithography Market is benefiting from the global expansion of semiconductor manufacturing facilities, particularly in regions such as Asia and North America. As of 2025, investments in semiconductor fabs are projected to reach unprecedented levels, with several countries aiming to bolster their domestic production capabilities. This expansion is driven by geopolitical factors and the need for supply chain resilience. Consequently, the demand for advanced photolithography equipment is expected to rise, as manufacturers seek to establish cutting-edge facilities. This trend indicates a robust growth potential for the Photolithography Market, as companies invest in the latest technologies to enhance production efficiency and meet the increasing demand for semiconductor products. The interplay between regional investments and technological advancements will likely shape the future landscape of the industry.