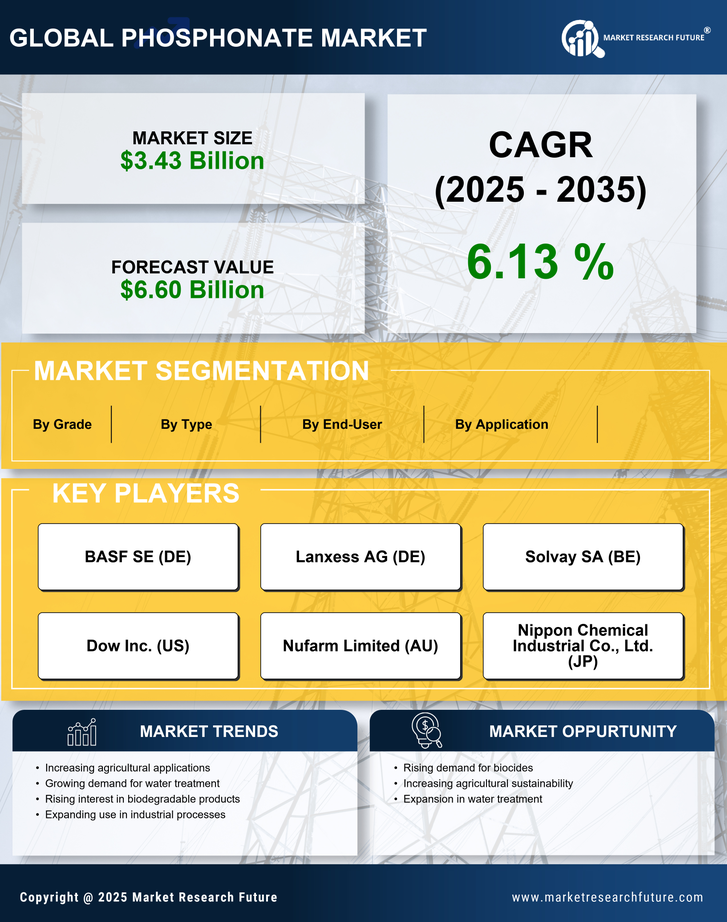

Increasing Agricultural Demand

The Phosphonate Market is experiencing a surge in demand due to the increasing need for agricultural productivity. As the global population continues to rise, the pressure on food production intensifies. Phosphonates, known for their efficacy in enhancing crop yields and protecting plants from diseases, are becoming essential in modern agriculture. In 2023, the agricultural sector accounted for approximately 40% of the total phosphonate consumption, indicating a robust market segment. This trend is likely to continue as farmers seek sustainable solutions to meet food security challenges. The Phosphonate Market is thus positioned to benefit from this growing agricultural demand, as more stakeholders recognize the value of phosphonates in improving crop resilience and productivity.

Rising Industrial Applications

The Phosphonate Market is experiencing growth due to the rising applications of phosphonates in various industrial sectors. Industries such as water treatment, oil and gas, and detergents are increasingly utilizing phosphonates for their chelating and scale-inhibiting properties. In 2023, the industrial segment represented nearly 30% of the total phosphonate market, highlighting its significance. As industries seek to enhance operational efficiency and reduce environmental impact, the demand for phosphonate-based products is expected to rise. This trend indicates a diversification of the Phosphonate Market, as it expands beyond agriculture into broader industrial applications, thereby creating new opportunities for manufacturers and suppliers.

Regulatory Support for Sustainable Practices

The Phosphonate Market is bolstered by increasing regulatory support for sustainable agricultural practices. Governments and regulatory bodies are implementing policies that encourage the use of environmentally friendly agrochemicals, including phosphonates. These regulations aim to reduce the environmental impact of traditional fertilizers and pesticides, promoting the adoption of phosphonates as a safer alternative. In recent years, several countries have introduced incentives for farmers to utilize phosphonate-based products, which has led to a notable increase in their market penetration. This regulatory landscape not only supports the growth of the Phosphonate Market but also aligns with the global shift towards sustainable farming practices, making phosphonates a preferred choice among agricultural stakeholders.

Technological Innovations in Phosphonate Production

The Phosphonate Market is witnessing advancements in production technologies that enhance the efficiency and effectiveness of phosphonate manufacturing. Innovations such as improved synthesis methods and the development of novel formulations are contributing to higher product quality and lower production costs. For instance, recent technological breakthroughs have enabled manufacturers to produce phosphonates with greater purity and stability, which are crucial for agricultural applications. This has resulted in a competitive edge for companies that adopt these technologies, potentially increasing their market share. As the demand for high-quality phosphonate products rises, the Phosphonate Market is likely to expand, driven by these technological innovations that cater to the evolving needs of consumers.

Consumer Awareness and Demand for Eco-Friendly Products

The Phosphonate Market is influenced by the growing consumer awareness regarding eco-friendly products. As consumers become more informed about the environmental impacts of agricultural practices, there is a noticeable shift towards sustainable and organic farming methods. This shift is driving demand for phosphonates, which are perceived as safer alternatives to conventional agrochemicals. Market Research Future indicates that approximately 25% of consumers are willing to pay a premium for products that are environmentally friendly, which is encouraging manufacturers to develop phosphonate-based solutions that align with these preferences. Consequently, the Phosphonate Market is likely to see increased investment in research and development to create innovative, eco-friendly products that cater to this evolving consumer demand.