Rising Demand for Biopharmaceuticals

The Pharmaceuticals Packaging Testing Equipment Market is experiencing growth due to the rising demand for biopharmaceuticals. As the biopharmaceutical sector expands, the need for specialized packaging solutions that ensure the stability and efficacy of biologics becomes critical. This trend is prompting pharmaceutical companies to invest in advanced testing equipment capable of assessing the unique requirements of biopharmaceutical packaging. The market for biopharmaceutical packaging is projected to grow at a CAGR of 8% over the next few years, indicating a robust demand for testing solutions tailored to this sector. Consequently, the increasing focus on biopharmaceuticals is likely to drive the development of innovative testing technologies.

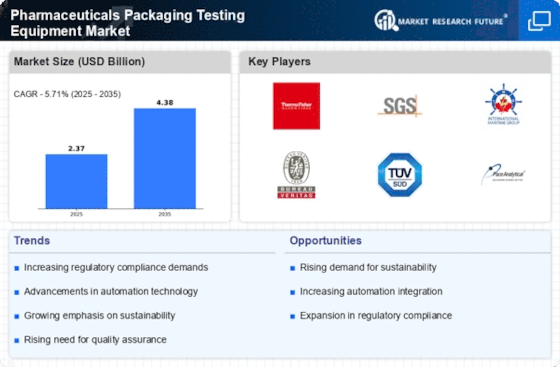

Regulatory Compliance and Quality Assurance

The Pharmaceuticals Packaging Testing Equipment Market is increasingly driven by stringent regulatory requirements imposed by health authorities. These regulations necessitate rigorous testing of packaging materials to ensure they meet safety and efficacy standards. As a result, pharmaceutical companies are investing in advanced testing equipment to comply with these regulations. The market for packaging testing equipment is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, reflecting the industry's commitment to quality assurance. This trend underscores the importance of reliable testing methods in maintaining product integrity and consumer safety, thereby propelling the demand for sophisticated testing solutions.

Focus on Sustainability in Packaging Solutions

The growing emphasis on sustainability is significantly influencing the Pharmaceuticals Packaging Testing Equipment Market. As environmental concerns gain prominence, pharmaceutical companies are increasingly adopting eco-friendly packaging materials. This shift necessitates the development of testing equipment that can evaluate the performance of sustainable materials. The market is witnessing a surge in demand for testing solutions that assess biodegradability and recyclability, aligning with global sustainability goals. It is estimated that the market for sustainable packaging testing equipment could reach USD 1 billion by 2027, highlighting the potential for growth in this segment. This focus on sustainability is likely to drive innovation in testing methodologies and equipment.

Technological Advancements in Testing Equipment

Technological innovations are reshaping the Pharmaceuticals Packaging Testing Equipment Market, leading to enhanced testing capabilities and efficiency. The introduction of automated testing systems and real-time monitoring technologies allows for more accurate assessments of packaging integrity. For instance, advancements in non-destructive testing methods enable manufacturers to evaluate packaging without compromising its integrity. This shift towards automation is expected to increase productivity and reduce operational costs, making it a key driver in the market. As companies seek to optimize their testing processes, the demand for cutting-edge equipment is likely to rise, further stimulating market growth.

Increasing Investment in Research and Development

Investment in research and development is a pivotal driver of the Pharmaceuticals Packaging Testing Equipment Market. Pharmaceutical companies are allocating substantial resources to R&D to develop new drugs and improve existing formulations. This focus on innovation necessitates rigorous testing of packaging materials to ensure they meet the evolving needs of new products. As a result, the demand for advanced testing equipment is expected to rise, with the market projected to reach USD 2.5 billion by 2026. This trend highlights the critical role of testing equipment in supporting the pharmaceutical industry's efforts to bring new therapies to market while ensuring compliance with regulatory standards.