Growing Focus on Energy Efficiency

The Global Petrochemical Pump Market Industry is witnessing a growing emphasis on energy efficiency as companies seek to reduce operational costs and minimize environmental impact. Energy-efficient pumps not only lower energy consumption but also enhance overall system performance. As industries become more aware of their carbon footprints, the demand for pumps that comply with energy efficiency standards is likely to increase. This trend is further supported by government incentives and initiatives aimed at promoting sustainable practices. Consequently, manufacturers are investing in research and development to create innovative pumping solutions that align with these energy efficiency goals.

Technological Advancements in Pump Design

Technological innovations are playing a crucial role in shaping the Global Petrochemical Pump Market Industry. Enhanced pump designs, including magnetic drive pumps and smart pumps equipped with IoT capabilities, are emerging to meet the stringent requirements of petrochemical applications. These advancements not only improve efficiency but also reduce maintenance costs and downtime. As companies increasingly adopt these technologies, the market is likely to see a shift towards more energy-efficient and environmentally friendly pumping solutions. This trend aligns with the broader industry movement towards sustainability, further propelling the growth of the market.

Regulatory Compliance and Safety Standards

The Global Petrochemical Pump Market Industry is significantly influenced by stringent regulatory frameworks and safety standards. Governments worldwide are implementing regulations to ensure the safe handling and transportation of hazardous materials, which directly impacts pump design and functionality. Compliance with these regulations necessitates the adoption of advanced pumping solutions that can withstand high pressures and corrosive environments. As a result, manufacturers are compelled to innovate and enhance their product offerings to meet these safety standards. This regulatory landscape not only drives demand for specialized pumps but also fosters a competitive environment among manufacturers striving for compliance.

Increasing Demand for Petrochemical Products

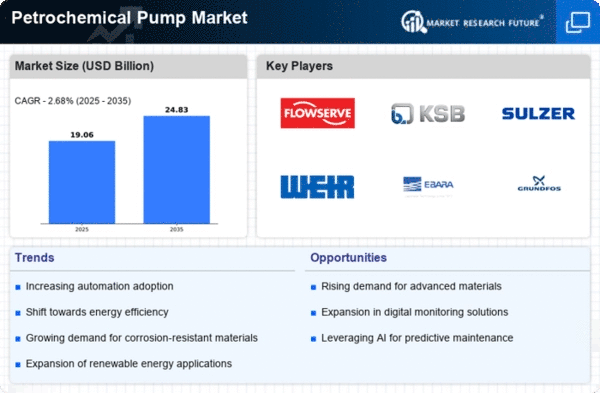

The Global Petrochemical Pump Market Industry is experiencing a surge in demand for petrochemical products, driven by the growing consumption of plastics, synthetic fibers, and other derivatives. As industries such as automotive, construction, and packaging expand, the need for efficient pumping solutions becomes paramount. In 2024, the market is projected to reach 18.6 USD Billion, reflecting a robust growth trajectory. This demand is likely to continue, with projections indicating a market size of 24.8 USD Billion by 2035, suggesting a compound annual growth rate of 2.68% from 2025 to 2035. Such growth necessitates advanced pumping technologies to ensure operational efficiency and reliability.

Rising Investments in Infrastructure Development

Infrastructure development is a key driver of growth in the Global Petrochemical Pump Market Industry. Governments and private sectors are investing heavily in the construction of refineries, chemical plants, and distribution networks to meet the increasing demand for petrochemical products. These investments create a substantial need for reliable pumping systems capable of handling various fluids under diverse conditions. As infrastructure projects expand globally, the demand for high-performance pumps is expected to rise, further contributing to the market's growth. This trend underscores the importance of robust pumping solutions in supporting the petrochemical supply chain.