E-commerce Expansion

The Global Pet Snacks and Treats Market Industry is witnessing a transformation due to the rapid expansion of e-commerce platforms. Online shopping provides convenience and accessibility for consumers, allowing them to explore a wider range of products than traditional retail channels. This shift is particularly pronounced among younger demographics who prefer the ease of purchasing pet snacks and treats online. As e-commerce continues to grow, it is anticipated that the market will benefit from increased sales and brand visibility. The Global Pet Snacks and Treats Market Industry is projected to reach 133.3 USD Billion by 2035, driven in part by this digital retail evolution.

Humanization of Pets

The trend of pet humanization significantly impacts the Global Pet Snacks and Treats Market Industry, as pet owners increasingly view their pets as family members. This perspective drives demand for premium and gourmet snacks that mirror human food trends. Pet owners are willing to spend more on high-quality treats that reflect their own dietary preferences, such as organic, gluten-free, or artisanal options. This shift in consumer behavior is reshaping the market landscape, as brands adapt their offerings to meet these evolving expectations. The growing humanization of pets is likely to continue influencing purchasing decisions and market growth.

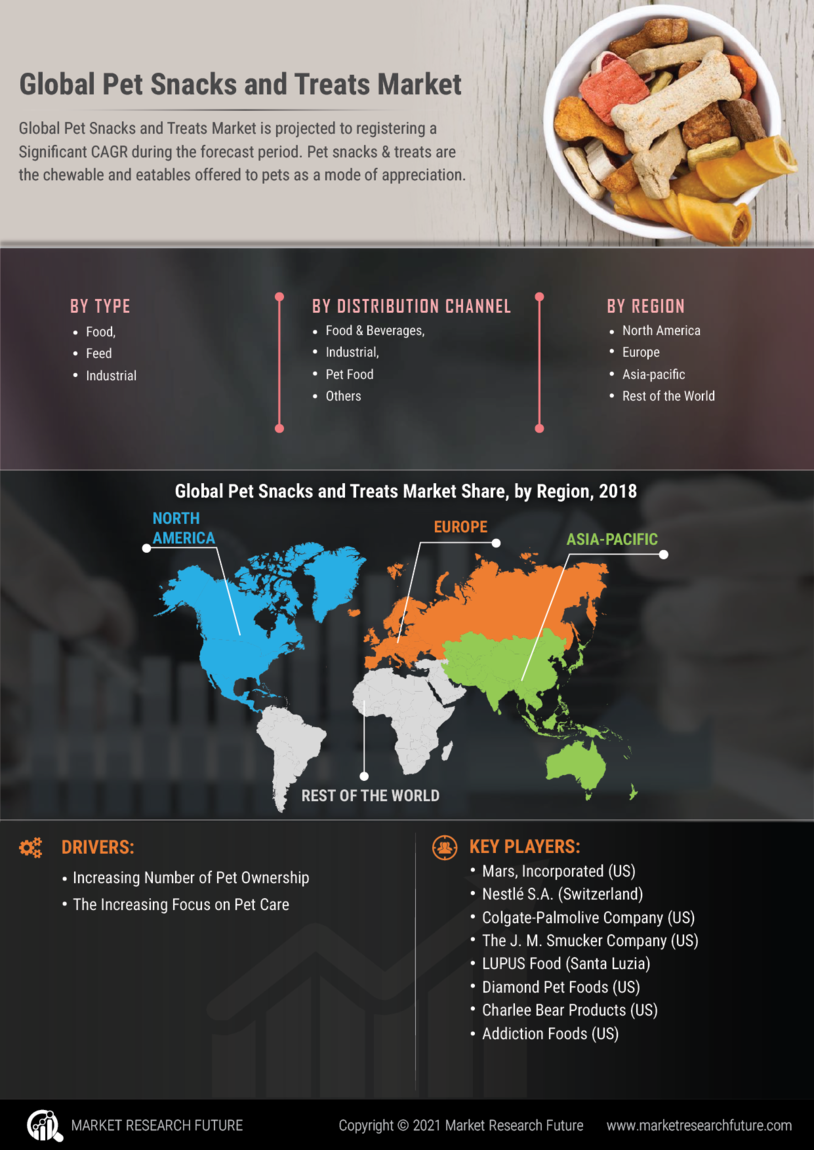

Rising Pet Ownership

The Global Pet Snacks and Treats Market Industry experiences growth driven by an increase in pet ownership worldwide. As more households adopt pets, the demand for snacks and treats rises correspondingly. According to recent statistics, pet ownership rates have surged, with approximately 70% of households in the United States owning at least one pet. This trend is mirrored globally, as urbanization and changing lifestyles lead to a greater affinity for pets. The Global Pet Snacks and Treats Market Industry is projected to reach 78.7 USD Billion in 2024, reflecting the increasing consumer willingness to invest in high-quality products for their pets.

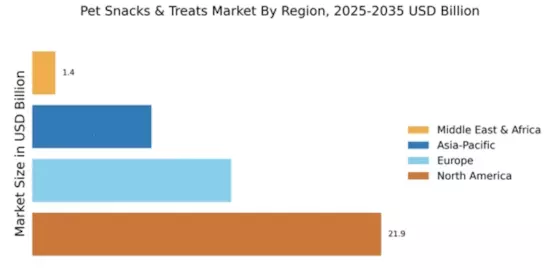

Market Growth Projections

The Global Pet Snacks and Treats Market Industry is poised for substantial growth, with projections indicating a market size of 78.7 USD Billion in 2024 and an anticipated increase to 133.3 USD Billion by 2035. This growth trajectory suggests a robust demand for pet snacks and treats, driven by various factors including rising pet ownership, health trends, and innovative product offerings. The compound annual growth rate (CAGR) of 4.91% from 2025 to 2035 further underscores the market's potential for expansion. These projections highlight the dynamic nature of the industry and the opportunities for stakeholders to capitalize on emerging trends.

Health and Wellness Trends

The Global Pet Snacks and Treats Market Industry is significantly influenced by the growing emphasis on health and wellness among pet owners. Consumers are increasingly seeking snacks and treats that offer nutritional benefits, such as functional ingredients that support pets' overall health. This trend is evident in the rising popularity of organic and natural pet treats, which cater to health-conscious pet owners. As a result, manufacturers are innovating to create products that align with these preferences. The market is expected to grow at a CAGR of 4.91% from 2025 to 2035, indicating a sustained interest in health-oriented pet snacks and treats.

Innovative Product Offerings

Innovation plays a crucial role in the Global Pet Snacks and Treats Market Industry, as manufacturers continuously develop new and unique products to capture consumer interest. This includes the introduction of treats that cater to specific dietary needs, such as grain-free or high-protein options. Additionally, the incorporation of novel ingredients, such as superfoods, is becoming increasingly popular. These innovations not only attract health-conscious consumers but also differentiate brands in a competitive market. As the industry evolves, the focus on unique and innovative product offerings is likely to drive growth and enhance market dynamics.