Permanent Magnet Size

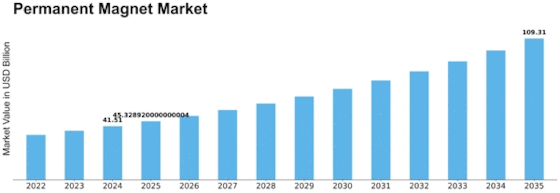

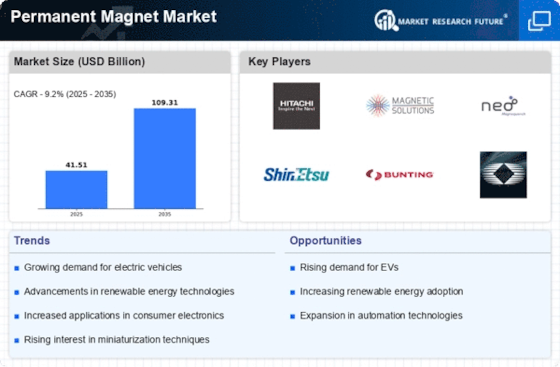

Permanent Magnet Market Growth Projections and Opportunities

Many market drivers determine the dynamics of the Permanent Magnet Market. One very crucially important aspect is the growing need for energy-efficient technologies among numerous industries. In the wake of sustainable practices, permanent magnets which do not need an external source to retain magnetism have come in very handy for making energy efficient products such as electric vehicles, wind turbines, and other renewable systems. This increased demand has driven the development of the permanent magnet market. Furthermore, the automotive industry has a very significant impact on shaping the permanent magnet market. As the world is moving towards EVs, permanent magnets especially neodymium-based ones are crucial elements in motor for electric cars. With countries across the world imposing tough emission policies and subsidizing EVs, the permanent magnets demand for automotive continues to rise due to the growing requirement. This trend will continue, leading to the development of the permanent magnet market in the near future. Another important driver for the permanent magnet market is the increasing automation in the industries. Of course, permanent magnets play a crucial role in the production of various types of automation equipment such as robotics and also industrial machines. It is also due to factors such as the need for higher efficiencies, cheaper labor sources and also more accurate manufacturing processes. With the advent of Industry 4.0 and also smart manufacturing, more industries are adopting permanent magnets as a very critical component in their automation equipment. First of all, the rare earth elements market has a very vital role in shaping the progression path for permanent magnet markets. Rare earth elements neodymium and also samarium are two of the most important ingredients in high-performing permanent magnets. It is the accessibility and pricing of these rare earth elements that directly determines what permanent magnets cost. The fluctuation of the permanent magnet market is alot affected by interruptions in the supply chain of rare earth elements, typically guided by geopolitics. Further, developments in the technology and material science help alot in the devolopment of permanent magnet market. Many researchers and manufacturers strive to develop new materials, as well as the manufacturing methods in order to increase the quality of permanent magnets on efficiency levels. Innovations in the magnet technology are a driving factor, producing more efficient and durable magnets that widen the customer base range of applications as well as enhance overall products performance. The permanent magnet market is also highly influenced by the global economic structure. Such impacts are economic fluctuations, uncertainties in investments that can affect the industries at different stages requiring permanent magnets. If industries grow or shrink with the changes in the economy, there will be related variations of permanent magnet demand.

Leave a Comment