Market Trends

Key Emerging Trends in the Perishable Goods Transportation Market

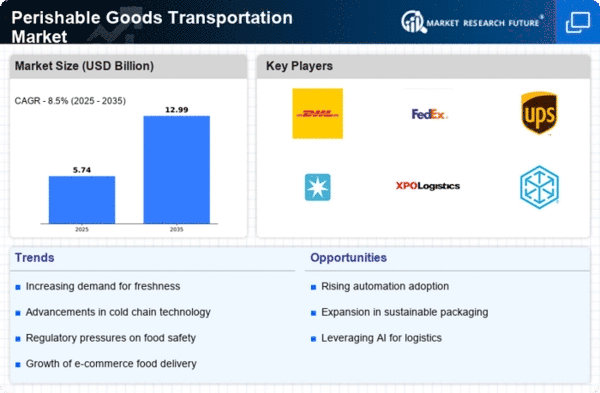

The Perishable Goods Transportation Market is currently witnessing dynamic trends driven by the global demand for efficient and reliable transportation solutions for perishable products, including fresh produce, dairy, meat, and pharmaceuticals. One significant trend is the growing adoption of advanced technologies in cold chain logistics to ensure the safe and timely transportation of perishable goods. The integration of temperature monitoring systems, GPS tracking, and real-time visibility solutions is enhancing the traceability and transparency of the supply chain, minimizing the risk of spoilage, and optimizing the overall efficiency of perishable goods transportation.

Moreover, the e-commerce boom is playing a pivotal role in reshaping the Perishable Goods Transportation Market. The increasing consumer preference for online grocery shopping and the surge in direct-to-consumer delivery models are driving the need for specialized transportation services for perishable goods. Companies are investing in last-mile delivery solutions with temperature-controlled vehicles to meet the specific requirements of e-commerce platforms, ensuring that perishable products reach consumers in optimal condition. This trend reflects the changing landscape of perishable goods distribution, with a greater focus on convenience and the direct delivery of fresh products to consumers' doorsteps.

Globalization and the expansion of international trade are influencing trends in the Perishable Goods Transportation Market. With perishable goods being traded across borders, there is a growing demand for reliable and efficient transportation solutions that comply with international regulations and standards. The use of advanced refrigeration and cold storage technologies in ocean, air, and land transportation is ensuring that perishable products maintain their quality and safety throughout the global supply chain. This trend aligns with the increasing need for seamless cross-border logistics to meet the demands of a globalized perishable goods market.

Technological advancements in refrigeration and insulation materials are shaping market trends in the Perishable Goods Transportation Market. Innovations in temperature-controlled containers, refrigerated trucks, and thermal packaging are improving the efficiency of perishable goods transportation, extending the shelf life of products, and reducing waste. This trend is crucial for meeting the evolving needs of industries where the transportation of perishable goods is a critical component, such as the food and pharmaceutical sectors. The industry's focus on continuous innovation is driving the development of solutions that address the challenges of maintaining specific temperature conditions during transportation.

Sustainability considerations are becoming increasingly important in shaping market dynamics in the Perishable Goods Transportation Market. As the transportation sector faces pressure to reduce its environmental impact, companies are exploring eco-friendly refrigeration technologies, alternative fuels, and sustainable packaging solutions for perishable goods. This trend aligns with the broader industry movement towards environmentally responsible practices, reflecting the commitment to reducing carbon emissions and minimizing the ecological footprint of perishable goods transportation.

Regulatory considerations and adherence to food safety standards are pivotal factors shaping market dynamics in the Perishable Goods Transportation Market. Given the sensitivity of perishable products to temperature variations, regulatory bodies and industry organizations are implementing stringent guidelines to ensure the safety and quality of transported goods. Companies are investing in compliance management systems and training programs to meet these regulatory requirements, providing assurances to consumers and stakeholders regarding the safety of perishable goods during transportation.

Strategic collaborations and partnerships are emerging as trends in the Perishable Goods Transportation Market. Companies are exploring synergies through alliances, joint ventures, and collaborations to enhance their global reach, optimize transportation networks, and improve overall supply chain efficiency. The collaborative approach allows for the exchange of expertise, resources, and market insights, fostering innovation and ensuring the continuous growth of the perishable goods transportation industry.

Leave a Comment