Increased Focus on Male Health Awareness

The growing emphasis on male health awareness is contributing to the expansion of the Penile Implant Market. Campaigns aimed at educating men about sexual health issues, including erectile dysfunction, are becoming more prevalent. This increased awareness encourages men to seek medical advice and explore treatment options, including penile implants. Data indicates that men who are informed about their health are more likely to pursue surgical solutions when faced with ED. Consequently, the Penile Implant Market stands to gain from this trend, as more men become proactive in addressing their sexual health concerns.

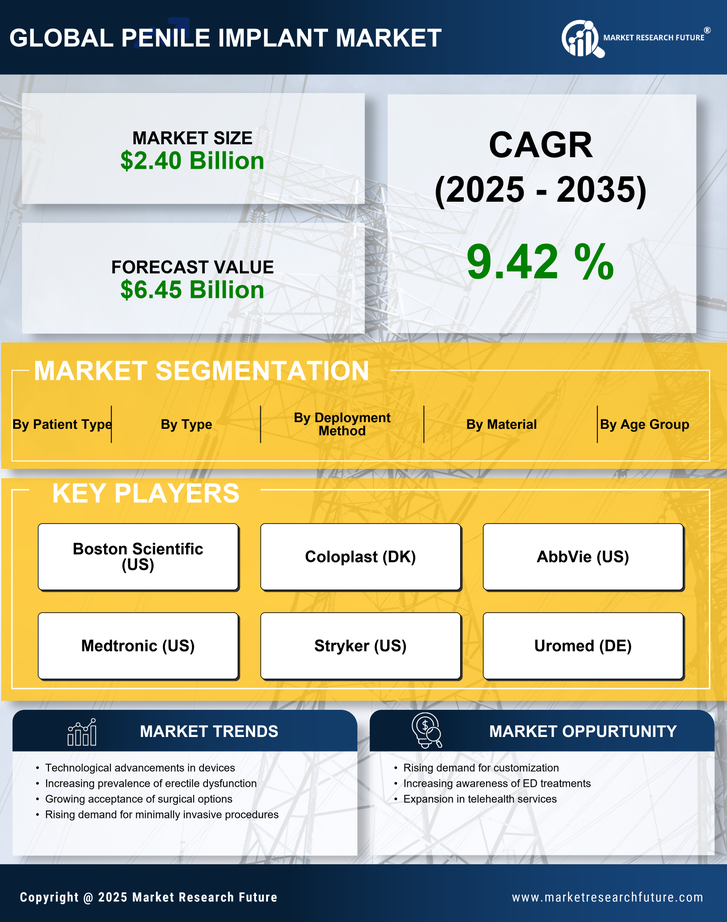

Rising Incidence of Erectile Dysfunction

The increasing prevalence of erectile dysfunction (ED) among men appears to be a primary driver for the Penile Implant Market. Studies indicate that approximately 30 million men in the United States alone experience ED, with numbers likely rising due to factors such as aging populations and lifestyle choices. This growing incidence necessitates effective treatment options, leading to heightened demand for penile implants. As awareness of ED improves, more men are seeking solutions, which could potentially expand the market further. The Penile Implant Market is thus positioned to benefit from this trend, as healthcare providers increasingly recommend surgical interventions for patients who do not respond to conventional therapies.

Aging Population and Changing Demographics

The aging population is a crucial factor driving the Penile Implant Market. As life expectancy increases, a larger segment of the population is entering the age bracket where erectile dysfunction becomes more common. Projections suggest that by 2030, the number of men aged 65 and older will significantly rise, leading to a corresponding increase in ED cases. This demographic shift is likely to create a sustained demand for penile implants as older men seek effective solutions to maintain their quality of life. The Penile Implant Market is thus poised to experience growth as it adapts to the needs of this aging demographic.

Technological Innovations in Implant Design

Technological advancements in the design and functionality of penile implants are significantly influencing the Penile Implant Market. Innovations such as inflatable and malleable implants have enhanced patient satisfaction and outcomes. Recent data suggests that the satisfaction rate among patients receiving these implants can exceed 90%, indicating a strong preference for these advanced solutions. Furthermore, ongoing research into biocompatible materials and minimally invasive surgical techniques may lead to improved recovery times and reduced complications. As these technologies evolve, they are likely to attract more patients, thereby driving growth in the Penile Implant Market.

Insurance Coverage and Reimbursement Policies

The evolving landscape of insurance coverage and reimbursement policies is impacting the Penile Implant Market. As more insurance providers recognize erectile dysfunction as a legitimate medical condition, coverage for penile implants is becoming more accessible. Recent trends indicate that an increasing number of health plans are including penile implants in their coverage, which may alleviate financial barriers for patients. This shift could lead to a rise in the number of men opting for surgical interventions, thereby driving growth in the Penile Implant Market. Enhanced reimbursement policies may also encourage healthcare providers to recommend these solutions more frequently.