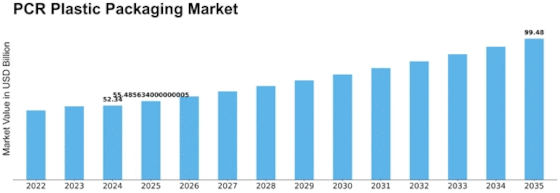

Pcr Plastic Packaging Size

PCR Plastic Packaging Market Growth Projections and Opportunities

The PCR (Post-Consumer Recycled) plastic packaging market is significantly influenced by several key factors that shape its dynamics and growth trajectory. One primary factor is the increasing awareness and concern about plastic pollution and environmental sustainability. As consumers, businesses, and governments prioritize the reduction of plastic waste and the promotion of circular economy principles, there is a growing demand for packaging solutions made from recycled materials. PCR plastic packaging, which is manufactured using post-consumer recycled plastic resin, offers a sustainable alternative to traditional plastic packaging materials. This trend is driven by consumer preferences for eco-friendly products, corporate sustainability goals, and regulatory initiatives aimed at promoting the use of recycled materials in packaging.

Moreover, technological advancements play a crucial role in shaping market dynamics within the PCR plastic packaging industry. Manufacturers are investing in research and development to improve the quality, performance, and processability of PCR plastic resins. Advanced recycling technologies, such as mechanical recycling, chemical recycling, and depolymerization, enable the conversion of post-consumer plastic waste into high-quality recycled resins suitable for packaging applications. Additionally, innovations in packaging design, material science, and polymer blending techniques contribute to enhancing the strength, durability, and aesthetic appeal of PCR plastic packaging. These technological advancements drive product innovation, enabling manufacturers to offer a diverse range of PCR plastic packaging solutions tailored to specific industry requirements and application needs. Leading and medium-sized manufacturers in the global packaging sector are continually working to lower their carbon footprints and increase the quality of their range of extremely environmentally friendly but recyclable packaging solutions. Growing awareness amongst these package makers about environmentally friendly packaging strategies and activities is one of the key reasons driving the global PCR packaging market to expand.

Furthermore, regulatory requirements and sustainability initiatives significantly influence market factors in the PCR plastic packaging industry. Governments and regulatory bodies impose regulations and standards governing packaging materials, recycling targets, and environmental impact to promote sustainability and reduce plastic waste. PCR plastic packaging products must comply with regulations such as FDA (Food and Drug Administration) guidelines, EU directives, and industry certifications to ensure product safety, quality, and regulatory compliance. Moreover, sustainability initiatives such as Extended Producer Responsibility (EPR) programs, deposit-return schemes, and plastic packaging taxes incentivize the use of recycled materials and drive the adoption of PCR plastic packaging solutions. These regulatory requirements and sustainability initiatives create opportunities for manufacturers to invest in PCR plastic packaging technologies and expand their product offerings to meet evolving market demands.

Additionally, market factors such as raw material availability, pricing, and consumer perceptions influence the PCR plastic packaging market. Fluctuations in the prices of virgin plastic resins, which are used as feedstock for PCR plastic production, impact the cost competitiveness of PCR plastic packaging compared to conventional plastic packaging materials. Moreover, supply chain disruptions, such as fluctuations in plastic waste collection and recycling infrastructure, can affect the availability and quality of PCR plastic resins, affecting production schedules and pricing of PCR plastic packaging products. Furthermore, consumer perceptions and preferences for recycled content, recyclability, and environmental sustainability drive demand for PCR plastic packaging solutions, influencing purchasing decisions and brand loyalty.

Changing industry trends and customer preferences also shape market dynamics within the PCR plastic packaging industry. Companies across various sectors, including food and beverage, personal care, and household products, are increasingly incorporating sustainable packaging practices into their business strategies to meet consumer expectations and regulatory requirements. As a result, there is a growing demand for PCR plastic packaging solutions that offer environmental benefits, cost savings, and branding opportunities. Moreover, industry trends such as product differentiation, premiumization, and e-commerce packaging drive the adoption of PCR plastic packaging formats that enhance product visibility, shelf appeal, and consumer engagement. As industries evolve and adapt to changing market dynamics, the demand for PCR plastic packaging continues to grow, creating opportunities for manufacturers to innovate and expand their product offerings to meet evolving customer needs.

Leave a Comment