Increasing Urbanization Trends

The trend of urbanization is a significant driver for the PC Wire And Strand Market. As populations migrate towards urban areas, the demand for housing and commercial buildings escalates. This urban growth necessitates the use of high-strength materials, such as PC wires and strands, in construction projects. Recent statistics indicate that urban areas are expected to house nearly 70% of the global population by 2050, leading to a surge in construction activities. Consequently, the PC Wire And Strand Market is poised to experience substantial growth as it supplies essential materials for urban infrastructure development.

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is driving the PC Wire And Strand Market. As countries strive to meet energy targets, the demand for wind and solar energy infrastructure is surging. PC wires and strands are essential components in the construction of wind turbine towers and solar panel frameworks. According to recent data, the renewable energy sector is projected to grow at a compound annual growth rate of over 8% in the coming years. This growth is likely to create substantial opportunities for manufacturers within the PC Wire And Strand Market, as they supply materials that are critical for the development of sustainable energy solutions.

Regulatory Standards and Compliance

The establishment of stringent regulatory standards for construction materials is influencing the PC Wire And Strand Market. Governments are increasingly mandating the use of high-quality materials to ensure safety and durability in construction projects. Compliance with these regulations often requires the use of advanced PC wires and strands that meet specific performance criteria. As a result, manufacturers are compelled to innovate and enhance their product offerings to align with these standards. This regulatory landscape is likely to drive growth within the PC Wire And Strand Market, as companies adapt to meet the evolving demands of the construction sector.

Infrastructure Investment Initiatives

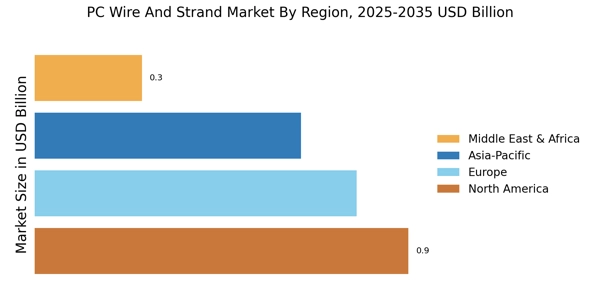

Government initiatives aimed at enhancing infrastructure are significantly impacting the PC Wire And Strand Market. With many nations prioritizing the upgrade of transportation networks, bridges, and buildings, the demand for high-strength materials is on the rise. The construction sector is expected to witness a growth rate of approximately 5% annually, which translates into increased consumption of PC wires and strands. These materials are vital for ensuring the structural integrity and longevity of various infrastructure projects. As investments in infrastructure continue to expand, the PC Wire And Strand Market stands to benefit from this upward trend.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of PC wires and strands are reshaping the PC Wire And Strand Market. Innovations such as automated production lines and advanced quality control systems are enhancing efficiency and product quality. These improvements not only reduce production costs but also enable manufacturers to meet the growing demand for high-performance materials. The introduction of new alloys and coatings is also expanding the application range of PC wires and strands. As these technologies evolve, they are likely to provide a competitive edge to companies within the PC Wire And Strand Market, fostering growth and market expansion.