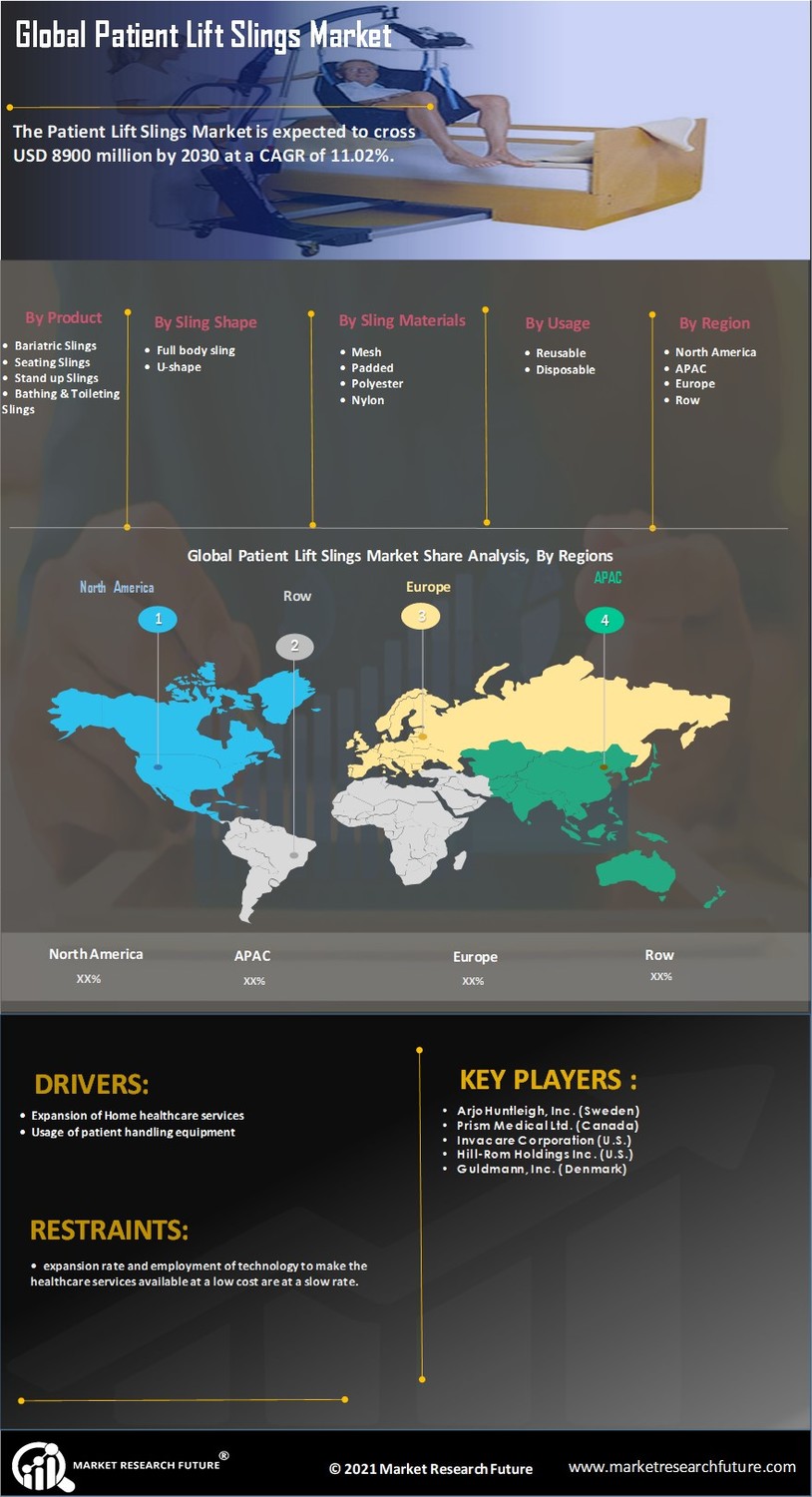

Expansion of Home Healthcare Services

The expansion of home healthcare services is emerging as a key driver of the Patient Lift Slings Market. As more patients prefer to receive care in the comfort of their homes, the demand for home healthcare solutions, including patient lift slings, is on the rise. This trend is supported by the increasing availability of home healthcare providers and the growing acceptance of home-based care among patients and families. Market data suggests that the home healthcare sector is experiencing rapid growth, driven by factors such as cost-effectiveness and personalized care. As a result, caregivers and families are seeking reliable patient handling equipment to ensure safe transfers and enhance the quality of care. The Patient Lift Slings Market is likely to benefit from this trend, as it aligns with the broader movement towards home-based healthcare solutions.

Aging Population and Rising Healthcare Needs

The aging population is a primary driver of the Patient Lift Slings Market. As individuals age, they often experience mobility challenges, necessitating the use of assistive devices such as patient lift slings. According to demographic data, the proportion of individuals aged 65 and older is projected to increase significantly, leading to a higher demand for healthcare services and products. This demographic shift is likely to result in a surge in the adoption of patient lift slings, as caregivers and healthcare facilities seek efficient solutions to assist elderly patients. Furthermore, the increasing prevalence of chronic conditions among older adults further emphasizes the need for effective patient handling equipment. Consequently, the Patient Lift Slings Market is expected to expand in response to these evolving healthcare needs.

Increased Awareness of Patient Safety and Care Quality

The heightened awareness surrounding patient safety and care quality is a significant driver of the Patient Lift Slings Market. Healthcare providers are increasingly recognizing the importance of minimizing the risk of injury to both patients and caregivers during transfers. This awareness has led to the implementation of stringent safety protocols and guidelines, which often include the use of appropriate patient handling equipment. Market Research Future suggests that facilities prioritizing patient safety are more likely to invest in high-quality patient lift slings, thereby driving market growth. Furthermore, regulatory bodies are also emphasizing the need for safe patient handling practices, which further propels the demand for reliable slings. As a result, the Patient Lift Slings Market is expected to expand as healthcare organizations strive to enhance care quality and ensure the safety of all stakeholders.

Rising Incidence of Disabilities and Chronic Illnesses

The increasing incidence of disabilities and chronic illnesses is a notable driver of the Patient Lift Slings Market. As the prevalence of conditions such as arthritis, stroke, and other mobility impairments rises, the demand for assistive devices, including patient lift slings, is likely to grow. Data indicates that millions of individuals worldwide live with disabilities that affect their mobility, necessitating the use of specialized equipment for safe transfers. Healthcare providers are thus compelled to adopt patient lift slings to ensure the safety and comfort of their patients. This trend is further supported by the growing emphasis on rehabilitation and long-term care, which often requires the use of patient handling equipment. Consequently, the Patient Lift Slings Market is poised for growth as it addresses the needs of an increasingly diverse patient population.

Technological Innovations in Patient Handling Equipment

Technological advancements play a crucial role in shaping the Patient Lift Slings Market. Innovations in materials and design have led to the development of more durable, lightweight, and user-friendly slings. For instance, the introduction of breathable fabrics and ergonomic designs enhances comfort for patients while ensuring safety during transfers. Additionally, the integration of smart technology, such as sensors and monitoring systems, is becoming increasingly prevalent. These innovations not only improve the functionality of patient lift slings but also contribute to better patient outcomes. Market data indicates that the demand for technologically advanced patient handling equipment is on the rise, as healthcare providers prioritize efficiency and safety. As a result, the Patient Lift Slings Market is likely to witness substantial growth driven by these technological advancements.