Focus on Ergonomics and Safety

The emphasis on ergonomics and safety within the Patient Lifting Equipment Market is becoming more pronounced. Healthcare providers are increasingly recognizing the importance of ergonomic designs that minimize physical strain on caregivers while ensuring patient comfort. This focus is likely to lead to a rise in demand for equipment that adheres to ergonomic principles, thereby enhancing workplace safety. Data suggests that ergonomic lifting devices can reduce workplace injuries by up to 30%, which is a compelling statistic for healthcare organizations aiming to improve staff retention and reduce costs associated with worker compensation. As a result, the Patient Lifting Equipment Market is expected to expand as facilities invest in safer, more ergonomic solutions.

Government Initiatives and Regulations

Government initiatives and regulations play a crucial role in shaping the Patient Lifting Equipment Market. Many countries are implementing stricter safety standards and guidelines for patient handling, which directly impacts the demand for compliant lifting equipment. These regulations often require healthcare facilities to invest in modern lifting solutions that meet safety criteria, thereby driving market growth. For instance, recent policy changes in several regions mandate the use of powered lifting devices in hospitals to reduce the risk of injury. This regulatory environment is likely to propel the Patient Lifting Equipment Market forward as facilities adapt to comply with new standards.

Rising Incidence of Mobility Disorders

The Patient Lifting Equipment Market is significantly influenced by the rising incidence of mobility disorders, which necessitates the use of specialized lifting equipment. Conditions such as arthritis, stroke, and other age-related ailments are becoming more prevalent, leading to an increased demand for patient lifting solutions. Recent statistics indicate that approximately 15% of the population is affected by mobility issues, creating a substantial market for lifting equipment. This trend is likely to drive innovation and investment in the Patient Lifting Equipment Market, as healthcare providers seek to accommodate the needs of patients with mobility challenges, thereby enhancing their quality of life.

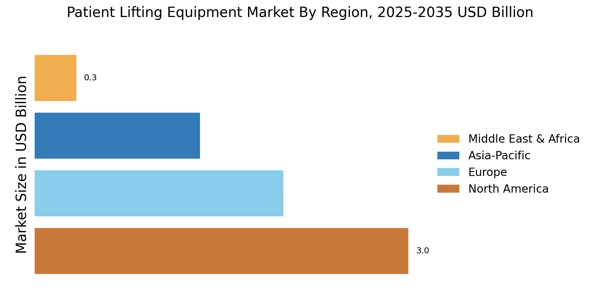

Increased Investment in Healthcare Infrastructure

The Patient Lifting Equipment Market is benefiting from increased investment in healthcare infrastructure, particularly in developing regions. As governments and private entities allocate more resources to enhance healthcare facilities, the demand for patient lifting equipment is expected to rise. This investment trend is driven by the need to improve patient care and operational efficiency in hospitals and nursing homes. Recent reports indicate that healthcare spending is projected to grow by 5% annually, which will likely include expenditures on modern lifting equipment. Consequently, the Patient Lifting Equipment Market is poised for growth as facilities upgrade their equipment to meet the demands of a more robust healthcare system.

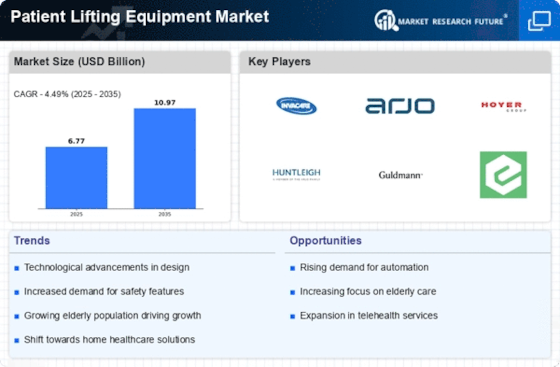

Technological Advancements in Patient Lifting Equipment

The Patient Lifting Equipment Market is experiencing a surge in technological advancements that enhance the efficiency and safety of patient handling. Innovations such as smart lifting devices equipped with sensors and automated systems are becoming increasingly prevalent. These technologies not only improve the user experience but also reduce the risk of injury for both patients and caregivers. According to recent data, the integration of advanced robotics in patient lifting equipment is projected to grow at a compound annual growth rate of 15% over the next five years. This trend indicates a shift towards more sophisticated solutions that cater to the evolving needs of healthcare facilities, thereby driving the Patient Lifting Equipment Market.